March 2025 Global Trade & Logistics Market Update

Ramadan 2025: Road Restrictions and Their Impact on Logistics in Abu Dhabi

With Ramadan 2025 approaching, Abu Dhabi has introduced restrictions on heavy vehicles during peak hours to reduce congestion and improve road safety. While beneficial for traffic flow, these measures significantly impact logistics operations, requiring businesses to adjust transportation schedules and optimize supply chains.

Heavy Vehicle Restrictions and Logistics Challenges

Peak Hour Ban on Heavy Vehicles

Abu Dhabi has restricted trucks and heavy vehicles during:

- Morning: 8:00 AM to 10:00 AM

- Afternoon: 2:00 PM to 4:00 PM

This affects logistics providers, particularly those handling perishable goods, FMCG, and e-commerce deliveries, as they must adjust schedules to avoid delays and disruptions.

While Abu Dhabi’s road restrictions improve traffic safety, they challenge logistics efficiency. Companies must adapt by rescheduling deliveries, optimizing storage, and ensuring driver well-being to maintain seamless supply chain operations during Ramadan 2025.

March 2025 Ocean Shipping Trends & Analysis

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Middle East – Asia

The launch of the Gemini Cooperation aims to improve reliability, while new tariffs on steel, aluminum, and imports from China impact trade flows.

Capacity – (=)

Rate – (+)

Middle East – Europe

Europe sees network enhancements, service adjustments, and port disruptions, with Rotterdam recovering from strikes and weather impacting schedules.

Capacity – (=)

Rate – (+)

Middle East – Latin America

Latin America faces port congestion and service adjustments, impacting cargo flow but with contingency plans in place.

Capacity – (-)

Rate – (+)

Inbound

Asia – Middle East

U.S. tariff changes disrupt Chinese exports, causing clearance delays and shifting trade routes, while Southeast Asia positions itself as an alternative manufacturing hub.

Capacity: (-)

Rate: (+)

Europe – Middle East

New transatlantic services, regulatory shifts, and anti-dumping measures reshape European exports, while e-commerce and trade agreements boost market activity.

Capacity – (=)

Rate – (+)

Latin America – Middle East

Export routes see service shifts, reduced surcharges, and regulatory changes, with some ports facing delays.

Capacity – (=)

Rate – (+)

Global Air Freight Performance – March 2025

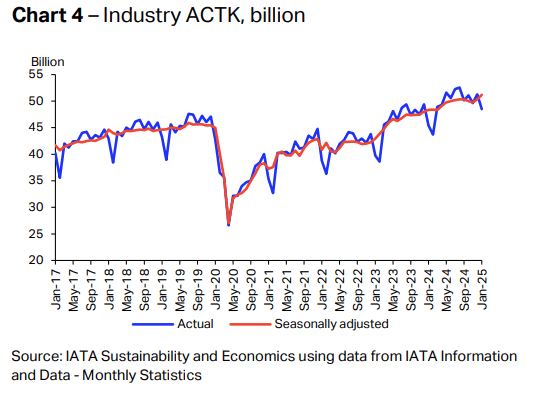

Demand: Global air cargo demand grew 3.2% YoY, with Latin America (10%) and North America (9.4%) leading growth, while Africa (-3.5%) and the Middle East (-8.3%) declined. Despite 18 consecutive months of expansion, demand slowed compared to previous years due to market uncertainties.

Capacity: Air cargo capacity rose 6.8% YoY, surpassing demand growth and lowering Cargo Load Factor (CLF) to 43.9%, a 17-month low. Belly-hold cargo expanded 10% YoY, now making up 55.2% of global air freight, while dedicated freighter capacity grew 4.2% YoY.

Rate: Air cargo yields increased 7.0% YoY due to e-commerce growth and ocean freight disruptions but dropped 9.9% MoM from seasonal shifts. Jet fuel prices declined 11.2% YoY, reducing operational costs, yet ongoing capacity growth puts downward pressure on rates.

The Middle East and Air Carriers

In January 2025, the Middle East experienced a sharp decline in air cargo demand (-8.3% YoY) after strong growth in 2024, likely due to geopolitical disruptions. Capacity also decreased (-1.2% YoY), leading to a 3.2 percentage point drop in Cargo Load Factor (CLF) to 41.0%, reflecting weakened market conditions.

Asia

Asia remained the key driver of global air cargo growth, with demand increasing 7.4% YoY, particularly on the Asia-North America route (+6.1% YoY). However, capacity expanded at a faster rate (+12.8% YoY), causing a 2.4 percentage point decline in CLF to 48.8%, signaling an oversupply in the market.

America

The Americas showed strong growth, with Latin America leading global expansion at 10% YoY and North America growing 9.4% YoY, supported by a 9.7% YoY rise on the Europe-North America trade lane. Capacity increased significantly (+11.1% YoY in Latin America and +9.5% YoY in North America), keeping North America’s CLF stable at 45.9%.

Europe

Europe saw modest demand growth of 1.3% YoY, with steady expansion on the Europe-North America (+9.7% YoY) and Europe-Asia (+2.3% YoY) routes. Capacity rose by 3.5% YoY, leading to a 1.2 percentage point drop in CLF to 53.8%, the highest among all regions, indicating a relatively balanced supply-demand environment.

Shipping Sector Updates from the UAE – March 2025

Maersk Reopens Bookings for Indian Ocean Islands and Mozambique Services. Read More

Maersk Announces Mauritius Local Charges Review Effective March 1, 2025. Read More

Maersk Announces Fuel Surcharge Adjustment for SAI Effective March 1, 2025. Read More

Maersk Announces Surcharge Review for Seychelles Effective February 14, 2025. Read More

Global Factory Output – Overview

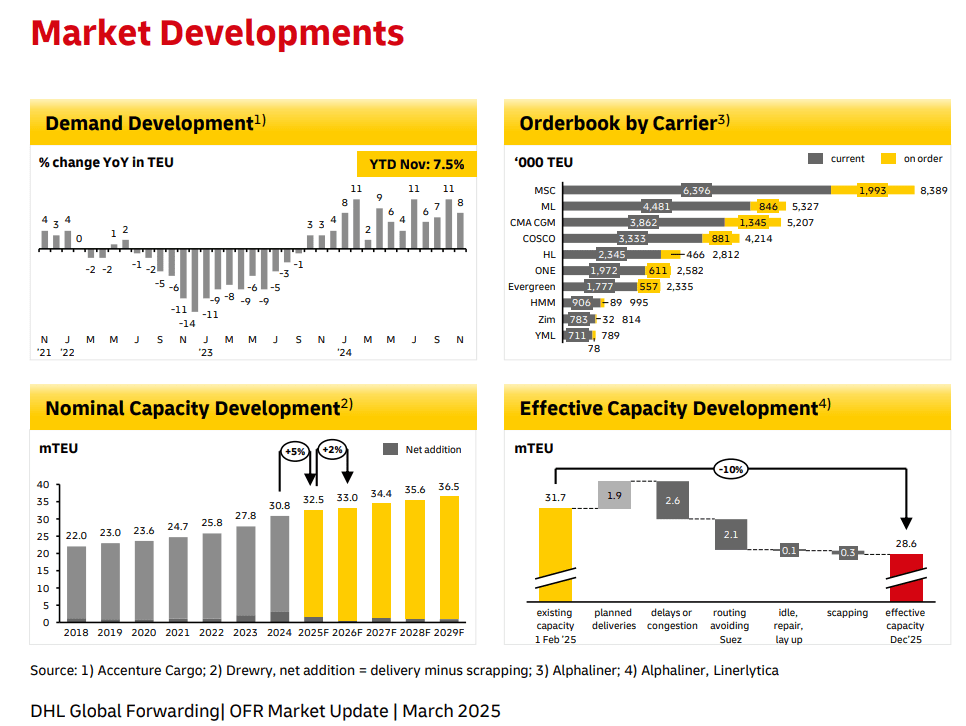

The World Container Index has decreased by 6% to $2,629 per 40ft container this week.

United States of America (USA)

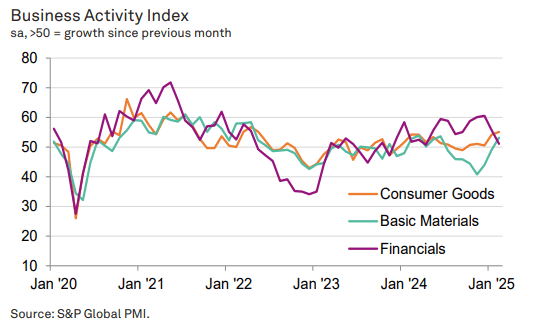

In February 2025, all seven monitored US sectors recorded growth, marking the first broad-based expansion since March 2024. Consumer Goods led the growth, with its fastest production increase since May 2022, while Basic Materials rebounded after seven months of decline. Technology also saw strong expansion, though Financials and Consumer Services slowed down, with Industrials being the weakest sector, growing at its slowest pace since early 2024.

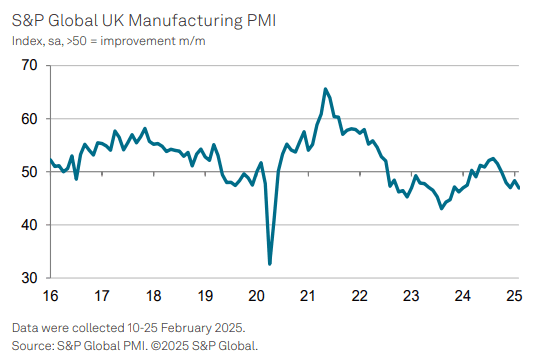

United Kingdom (UK)

In February 2025, UK manufacturers faced a worsening trading environment, with weak demand, low confidence, and rising costs driving declines in output and new orders. The Autumn Budget’s wage and tax changes intensified inflation fears and job losses, which are now at their highest rate since mid-2020. Input costs surged to a two-year high, while factory gate prices hit a 22-month high, creating a policy challenge for the Bank of England amid stagnant growth and rising inflation.

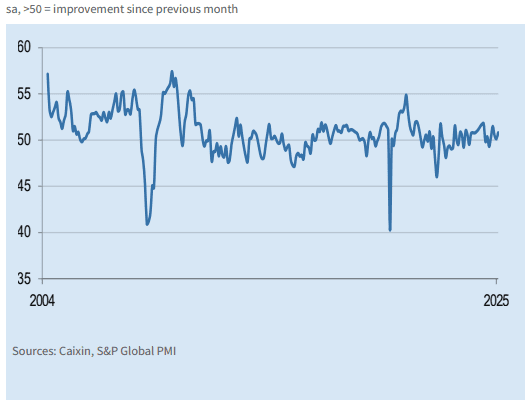

China

In February 2025, China’s manufacturing sector expanded at a faster pace, with output and new orders rising, pushing the PMI to a three-month high of 50.8. Foreign demand improved, and manufacturers increased purchasing activity, though employment continued to decline slightly as firms sought cost reductions. Input costs rose modestly, but output prices were discounted for a third month, while business confidence strengthened with expectations of higher demand and new product launches.

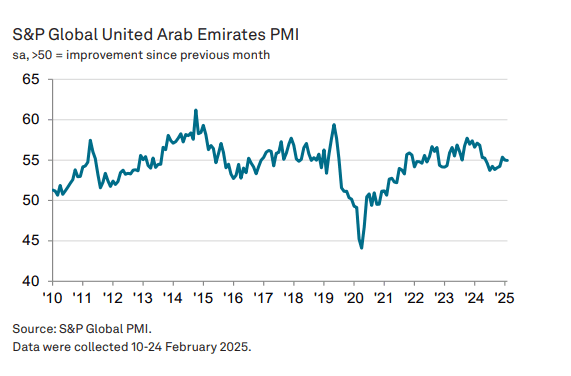

United Arab Emirates (UAE)

In February 2025, UAE’s non-oil sector maintained strong growth, with new orders and output rising steadily, reflected in a PMI of 55.0. However, competition kept price increases limited, despite rising cost pressures leading to slight inflation in selling prices. Weak job creation, administrative delays, and payment collection issues remain key challenges, potentially requiring policy action to support long-term stability.

Related Articles

March 2025 Global Trade & Logistics Market Update

Ramadan 2025: Road Restrictions and Their Impact on Logistics in Abu Dhabi With Ramadan 2025 approac

Monthly Update on the Global Logistics Market – February 2025

Major Shifts in Carrier Alliances Reshape Global Shipping Dynamics 2025 marks a pivotal year in the

January 2025 Supply Chain and Logistics Industry Outlook

Supply Chain Trends to Watch in 2025 In 2025, the supply chain industry is set to undergo significan

Post a comment

You must be logged in to post a comment.