Logistics Industry Monthly Brief – November 2024

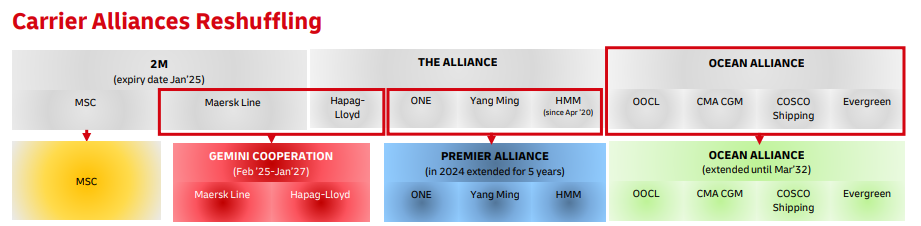

Major Shifts in Global Shipping Alliances Set for 2025

2M Alliance Set to Dissolve

MSC and Maersk Line will end their collaboration by January 2025, marking a significant shift in global maritime logistics. Post-2M, MSC plans to independently enhance its service offerings by entering VSAs and securing additional slots on other operators’ vessels.

New Alliances on the Horizon

Gemini Cooperation Begins: Starting February 2025, Maersk and Hapag-Lloyd will initiate the Gemini Cooperation, promising innovative logistics solutions through 2027. Gemini will adopt a hub-and-spoke network strategy to efficiently serve smaller ports directly, aligning closely with evolving market demands.

Premier Alliance Formation: HMM, ONE, and Yang Ming will launch the Premier Alliance in February 2025, enhancing East-West network capabilities.

Extended Collaborations

Ocean Alliance Extension: CMA CGM, COSCO Shipping, OOCL, and Evergreen extended their cooperation until March 2032, reinforcing their long-term strategic partnership.

Global Ocean Freight Insights – November 2024

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Middle East – Asia

Increased demand in sectors such as technology and consumer goods are tightening capacity and pushing up rates.

Capacity – (-)

Rate – (+)

Middle East – Europe

Challenges with port congestion in Rotterdam are causing delays and high yard density.

Capacity – (=)

Rate – (-)

Middle East – Latin America

The region faces operational challenges due to port congestion and political instability impacting logistics.

Capacity – (=)

Rate – (-)

Middle East – North America

Recovery is ongoing post-labor stoppage, with operations gradually normalizing and expected delays resolving.

Capacity – (=)

Rate: +

Asia – Middle East

Exports remain strong with the launch of the Gemini network, enhancing schedule reliability and operational efficiency.

Capacity: (+)

Rate: (=)

North America – Middle East

Steady exports with resilient consumer and business demand driving performance.

Capacity – (=)

Rate – (=)

Latin America – Middle East

Surges in export demands are met with increased surcharges to manage capacity effectively.

Capacity – (+)

Rate – (+)

Europe – Middle East

The route experiences significant fluctuations in traffic flow, with periodic constraints indicating a need for careful planning.

Capacity – (-)

Rate – (=)

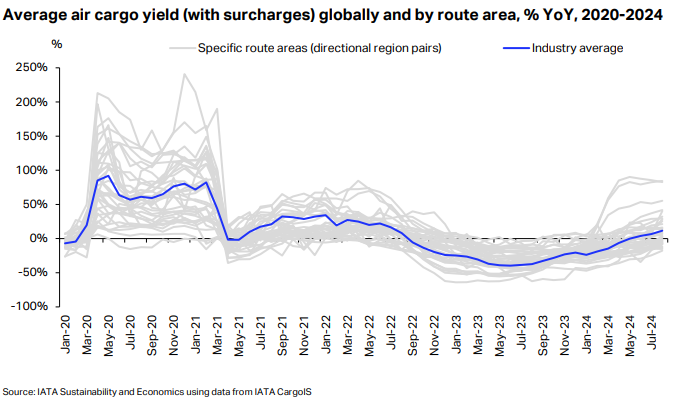

Air Freight Market Insights – November 2024

Demand: Robust demand continues in the air freight sector, fueled by an ongoing surge in global e-commerce and a strategic shift from sea freight to air due to recurring maritime disruptions. This trend underscores the resilience and adaptability of the air cargo market in response to fluctuating global trade dynamics.

Capacity: Despite reaching record levels, air cargo capacity is tightly contested, reflecting the scale of increased global shipments and the ongoing push for rapid delivery services. This situation is prompting carriers to optimize their cargo operations and consider expanding their fleets.

Rates: Air cargo rates are rising, becoming more competitive with maritime transport costs. This shift is influenced by persistent uncertainties in sea freight reliability and efficiency, which are making air freight a more appealing option for time-sensitive shipments.

The Middle East and Air Carriers

The Middle East serves as a crucial hub for rerouting Asian exports to global markets, significantly boosting air cargo yields due to high demand and limited capacity on these routes.

Asia

Asia remains a powerhouse in the air cargo sector, driving yields through direct shipments that cater to the robust demand in American and European markets. This region’s strategic position enhances its role in the global air freight logistics chain.

America

The American air freight market is adapting rapidly to shifts from maritime to air transport, influenced by the need for reliability and faster delivery times amidst ongoing global supply chain challenges.

Europe

Europe’s air cargo sector is experiencing a significant transition from sea to air shipping, driven by logistical challenges in maritime transport. This has led to increased demand and higher rates in the air freight market across the continent.

UAE Shipping Sector Insights – November 2024

CMA CGM announces Peak Season Surcharge adjustment effective from November 4, 2024, to March 31, 2025. Read More

Mandatory ACD Implementation for Yemen Shipments Starts January 1, 2025. Read More

CMA CGM Introduces Overweight Surcharge for Dry Cargo from Indian Subcontinent to South America East Coast Starting November 5, 2024. Read More

Maersk Launches New Container Tare Weight Feature on Maersk.com for Enhanced Customer Service. Read More

Hapag-Lloyd and Maersk Set to Launch Cape of Good Hope Network for Gemini Cooperation on February 1, 2025. Read More

EU’s Import Control System 2 (ICS2) – Release 3 Set for Go Live on November 13, 2024. Read More

Swire Shipping Launches Pacific Weekly Express Service to Enhance Connectivity to Papua New Guinea and the Pacific Islands. See More

Unifeeder Issues Advisory on Penalties for Misdeclaration of Hazardous Cargo. Read More

Jebel Ali Port Introduces New Anchorage and Harbour Master Services; Amends Tariff Clause Effective December 1, 2024. Read More

Maersk Announces Changes to Emergency Contingency Surcharges for X5ML Trades Effective November 1, 2024. Read More

Maersk Urges Regular Checks for Updated Red Sea Surcharges Due to Ongoing Regional Disruptions. Read More

Global Factory Output – Overview

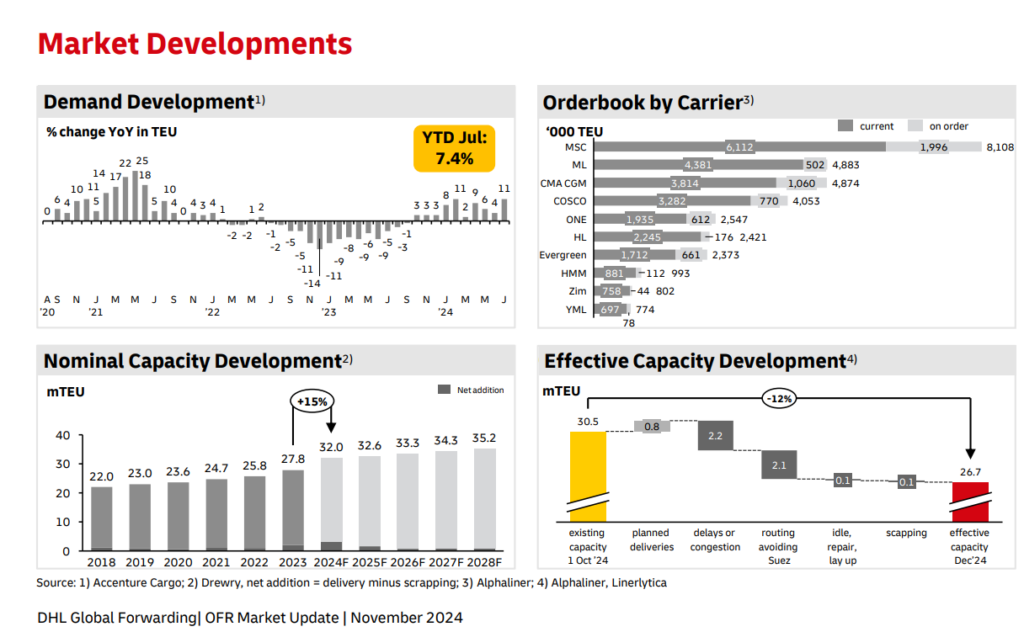

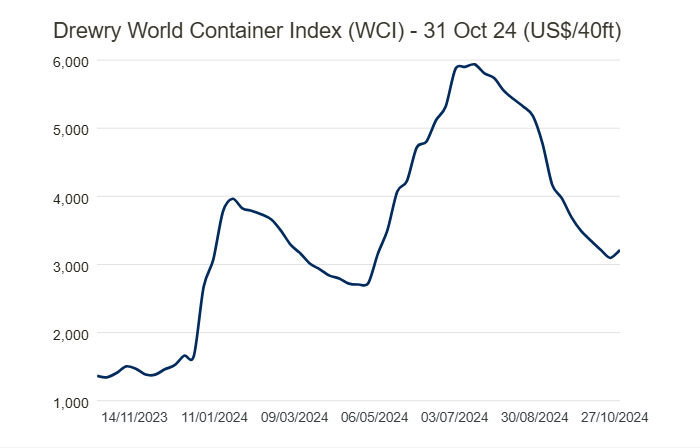

Drewry’s World Container Index has increased by 4% and now is valued at $3,213 per 40-ft container.

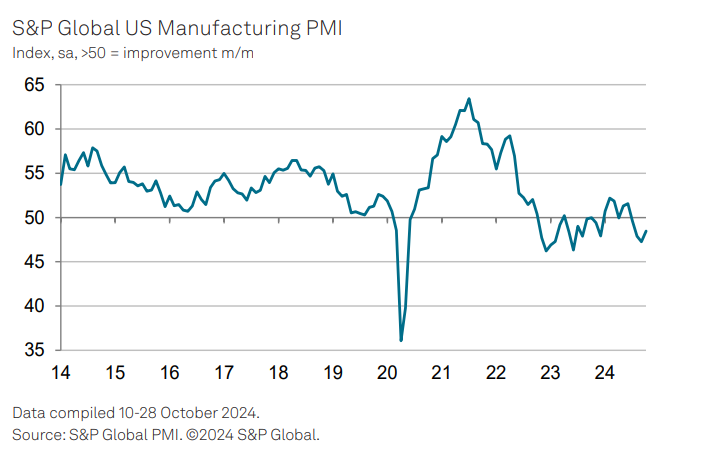

United States of America (USA)

The region faces operational challenges due to port congestion and political instability impacting logistics.

Capacity – (=)

Rate – (-)

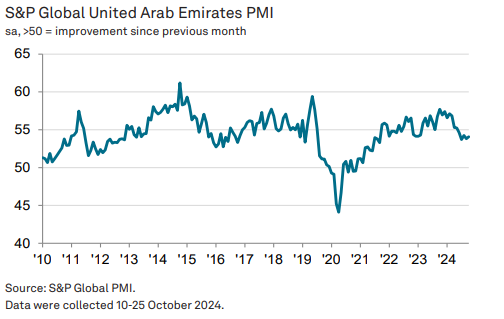

United Arab Emirates (UAE)

In October, the non-oil economy showed signs of weakening after a period of strong growth, with new business growth softening and job creation hitting a 30-month low due to increased market competition. To counter slow sales, firms lowered output prices for the first time in six months, coinciding with a reduction in input price pressures. Despite these challenges, a rise in business activity from a low base and sustained work backlogs suggest potential for continued economic growth, albeit at a possibly slower pace.

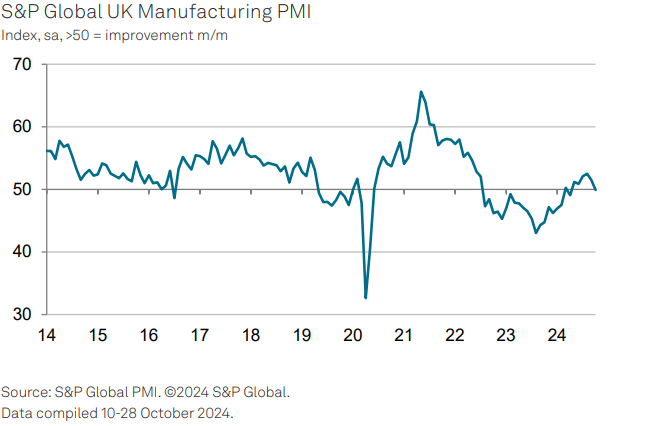

United Kingdom (UK)

UK manufacturing faced a downturn at the start of Q4 due to uncertainty over impending government policies and a reduction in export business, leading to a contraction in new work intakes for the first time since April. The PMI fell below the neutral 50 mark, reflecting subdued business sentiment. However, input cost inflation dropped to a ten-month low, potentially giving policymakers room to bolster growth. The upcoming November PMI is highly anticipated for insights into the Budget’s impact on the manufacturing sector and business confidence.

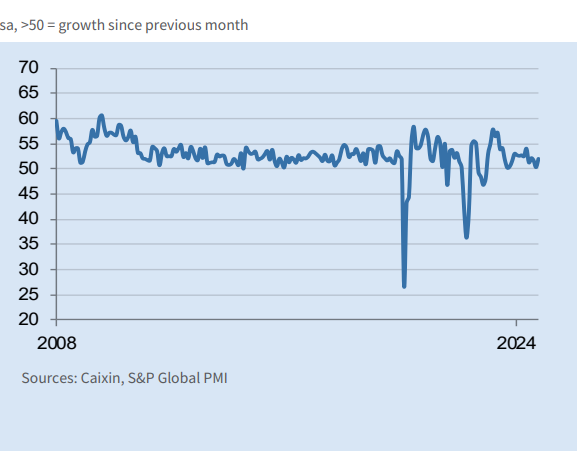

China

In October 2024, China’s service sector showed accelerated growth, with the Caixin China General Services Business Activity Index rising to 52.0 from 50.3 in September. This uptick was driven by new business and export orders, pushing activity to its fastest growth rate in three months. Despite this, backlogs of work increased. Firms raised staffing slightly in response to higher workloads, though input cost inflation eased and selling prices stabilized. Business confidence also improved, reaching its highest since May, buoyed by optimistic economic forecasts and promotional efforts.

Related Articles

March 2025 Global Trade & Logistics Market Update

Ramadan 2025: Road Restrictions and Their Impact on Logistics in Abu Dhabi With Ramadan 2025 approac

Monthly Update on the Global Logistics Market – February 2025

Major Shifts in Carrier Alliances Reshape Global Shipping Dynamics 2025 marks a pivotal year in the

January 2025 Supply Chain and Logistics Industry Outlook

Supply Chain Trends to Watch in 2025 In 2025, the supply chain industry is set to undergo significan

Post a comment

You must be logged in to post a comment.