April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics

Global Trade Disruptions & Rising Costs

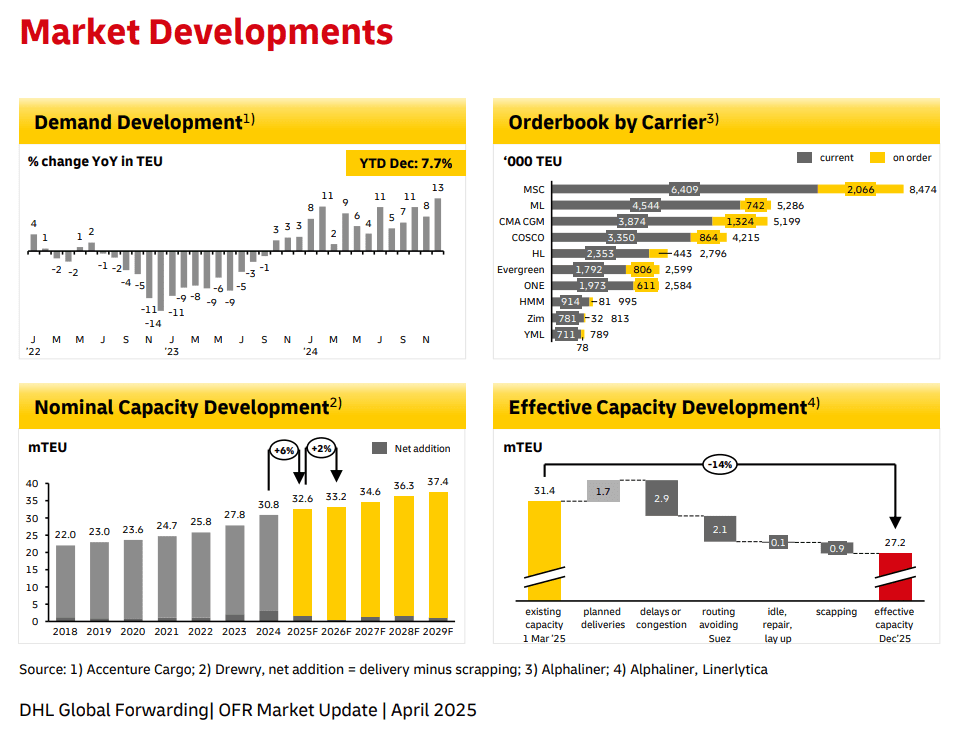

The U.S. proposal to impose steep port fees — up to $1.5 million per port call for Chinese-built vessels — aims to curb China’s dominance in global shipbuilding. With 32% of the global container fleet built in China, major operators like COSCO (60% Chinese-built fleet), CMA CGM (41%), and ZIM (43%) face significant cost burdens. These penalties are expected to ripple through global supply chains, raising shipping costs and potentially shifting orders to South Korea and Japan, both of which already dominate large container vessel construction.

Repercussions for the Middle East

For the Middle East, especially key hubs like the UAE, the effects could be twofold. On one hand, increased shipping costs will raise freight rates for goods flowing through the region. On the other, as companies reroute vessels to avoid high U.S. port fees, the Middle East may benefit from new transshipment opportunities and shifting trade lanes, especially for Europe-Asia traffic. However, capacity pressures and pricing volatility could impact regional importers and exporters.

Global Ocean Freight Trends & Insights – April 2025

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Middle East – Asia

Asia’s imports remain stable with flexible networks, optimized capacity, and smooth operations at Tanjung Pelepas hub, ensuring resilience amid shifting trade patterns.

Capacity – (+)

Rate – (=)

Middle East – Europe

Europe’s imports remain busy yet manageable, with stable northern ports, rising yard density in Southern Europe, and persistent congestion concerns at Antwerp.

Capacity – (+)

Rate – (=)

Middle East – Latin America

Inbound trade to Latin America improves with resumed services via Savannah, while Haiti’s instability poses potential risks to regional cargo flows.

Capacity – (+)

Rate – (=/-)

Middle East – North America

North America’s imports stay strong with high demand, tight space, Peak Season Surcharges, and rising LCL volumes amid inventory management and tariff uncertainties.

Capacity – (+)

Rate – (+)

Inbound

Asia – Middle East

Asia’s exports surge with strong demand, expanded fleet, high vessel utilization, and 94% schedule reliability; Maersk advises early bookings to secure space.

Capacity: (++)

Rate: (+)

North America – Middle East

North America’s exports see strong demand, full-capacity sailings, new services enhancing efficiency to Europe and Latin America, despite tight East Med and Canada delays.

Capacity – (+)

Rate – (+)

Europe – Middle East

Europe’s exports remain steady with strong schedule reliability, stable ports, and proactive cargo advancement, despite congestion in Antwerp and weather recovery in Tangier.

Capacity – (+)

Rate – (=)

Latin America – Middle East

Peru’s feeder service ends post-reefer season, shifting focus to Buenaventura, Colombia, to support rising export flows to South America’s west coast.

Capacity – (+)

Rate – (+)

Global Air Freight Performance – March 2025

Demand: Global air cargo demand is rebounding in early March 2025, driven by strong recovery from Asia and South and Central America. Key Asian exporters like China, South Korea, Vietnam, Hong Kong, and Japan are seeing improved volumes after a sharp decline at the end of February.

Capacity: Global air cargo capacity is steadily increasing, mainly supported by expanded passenger flight schedules ahead of summer, despite ongoing demand shifts and policy changes.

The Middle East and Air Carriers

Airfreight capacity to Lebanon is recovering as flights to Beirut resume, while Saudia Cargo sees double-digit growth driven by strong demand for Saudi fruit exports.

Asia

Demand and rates picked up in March with the typical quarter-end boost, while limited capacity growth and market uncertainty are driving up pricing pressures.

America

U.S.-Canada tariff tensions could impact both economies, while Mexico’s mango season boosts perishable demand amid flight disruptions from extreme heat in Mexico City.

Europe

Freighter operators are reallocating capacity from Europe to Asia to support rising e-commerce demand, while EU’s response to U.S. tariffs could affect air freight demand, customs, and rates.

UAE Shipping Sector Updates – April 2025

Maersk adjusts fuel surcharge effective 1st April 2025, following central energy fund updates; current surcharge remains unchanged. Read More

Maersk launches instant, automated Bill of Lading transfer on Maersk.com, streamlining processes and eliminating manual coordination. Read More

Maersk adds Hong Kong call to Safari Service from May 2, 2025, enhancing routes for South African citrus season.

Maersk introduces POI Equipment Positioning Service for global imports via Blantyre, effective March-April 2025, enhancing inland service reliability.

From April 1, 2025, ICS2 declarations require detailed shipment data for EU-bound cargo; MSC applies charges for incomplete filings. Read More

Maersk’s East-West network is 75% implemented, targeting 90%+ reliability, with Gemini Cooperation already achieving 94% schedule reliability. Read More

Global Factory Output – Overview

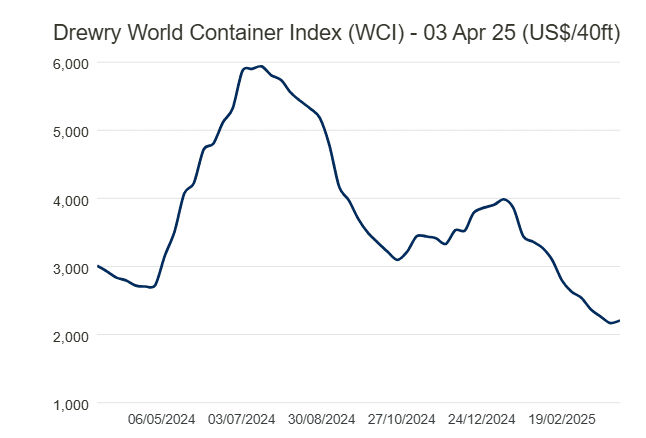

The Drewry’s World Container Index has increased by 2% to $2,208 per 40ft container.

United States of America (USA)

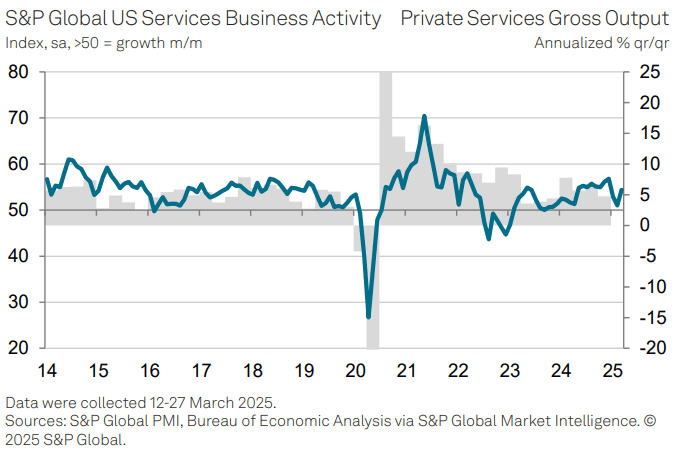

March saw a rebound in service sector activity and employment, but growth remains below late-2024 levels. GDP growth slowed to 1.5% in Q1, with concerns that March’s improvement may overstate momentum. Business optimism fell amid political uncertainty, rising costs, and tariffs, as supplier-driven price hikes accelerated to their fastest pace in two years.

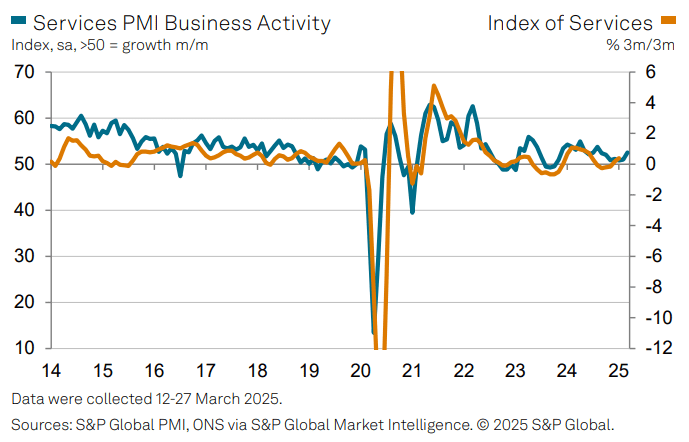

United Kingdom (UK)

UK service sector growth accelerated in March, led by tech and financial services, while other sectors lagged. Businesses faced rising costs, cautious demand, and geopolitical uncertainty. Hiring remained weak, with job cuts for the sixth month. Inflation pressures persisted as suppliers passed on higher payroll costs, prompting increased prices despite subdued order books.

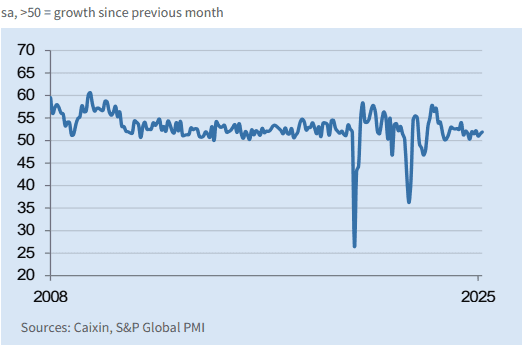

China

China’s service sector expanded in March, with faster growth in business activity and new orders, driven by domestic demand and supportive policies. Despite rising input costs, firms lowered prices amid competition. Employment declined modestly due to spare capacity and cost concerns. Business sentiment remained positive, though slightly moderated by global economic and geopolitical uncertainties.

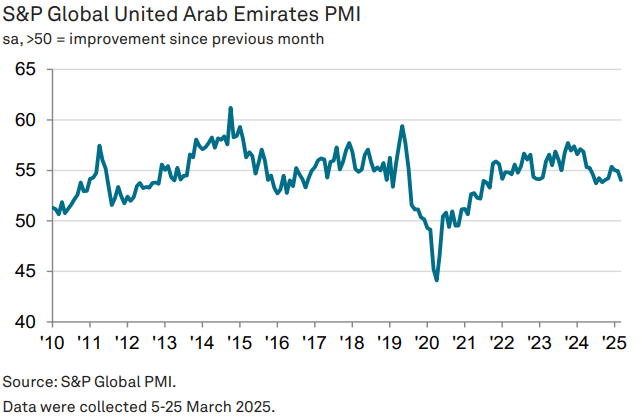

United Arab Emirates (UAE)

The UAE’s non-oil sector grew strongly in March, though new order growth softened for a third month. Firms ramped up input purchases to clear backlogs, despite payment delays. Inventory levels fell as inputs were swiftly used. However, hiring growth slowed to its weakest in nearly three years, hinting at recruitment challenges amid high demand.

Related Articles

April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics Global Trade Disruptions & Rising Costs

March 2025 Global Trade & Logistics Market Update

Ramadan 2025: Road Restrictions and Their Impact on Logistics in Abu Dhabi With Ramadan 2025 approac

Monthly Update on the Global Logistics Market – February 2025

Major Shifts in Carrier Alliances Reshape Global Shipping Dynamics 2025 marks a pivotal year in the

Post a comment

You must be logged in to post a comment.