Global Freight and Logistics Market Update l July 2024

Spot and Contract Rate Divergence Squeezes Freight Forwarders

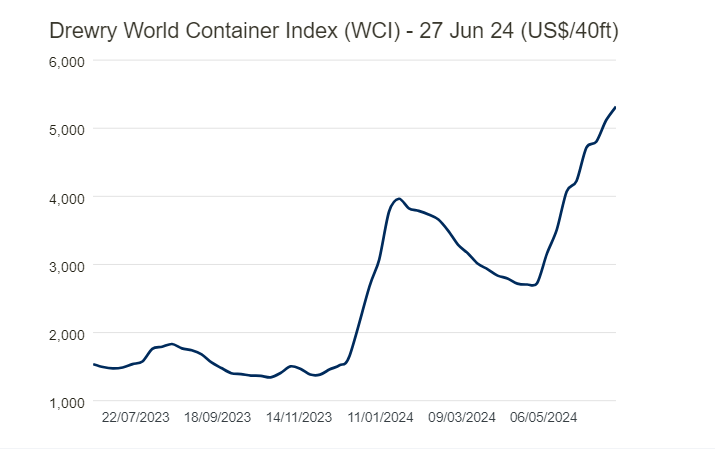

The disparity between spot and contract freight rates is growing, mirroring pandemic-era patterns and placing considerable pressure on freight forwarders.

Geopolitical Tensions and Operational Costs

Conflicts in the Middle East and Ukraine are causing route diversions and increased costs, impacting shipping schedules and rates.

Economic Impact on Freight Rates

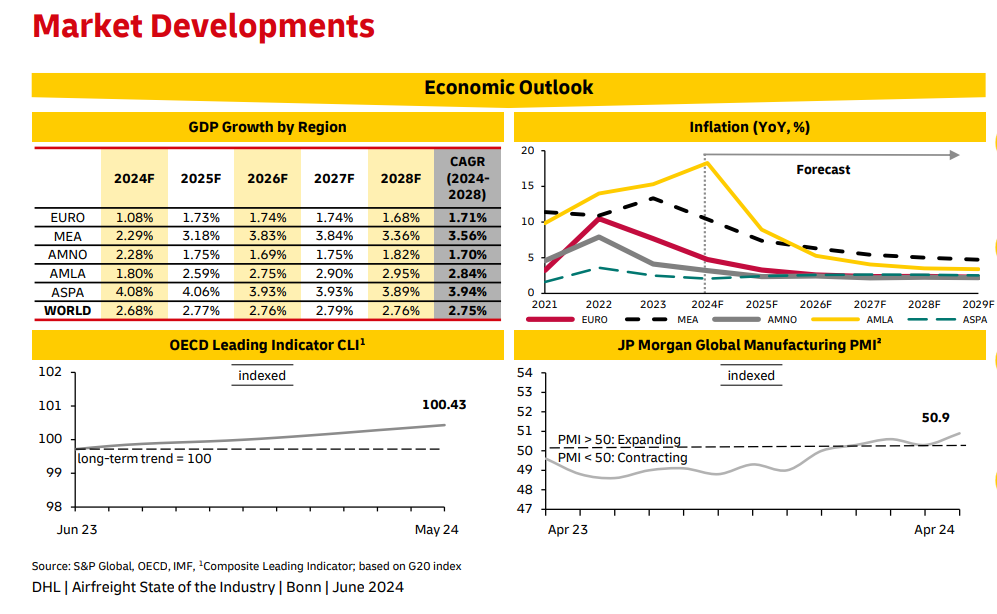

While demand for Ocean Freight Rates (OFR) remains strong in Q1, economic uncertainties and labor negotiations are causing rate fluctuations, squeezing smaller shippers and forwarders.

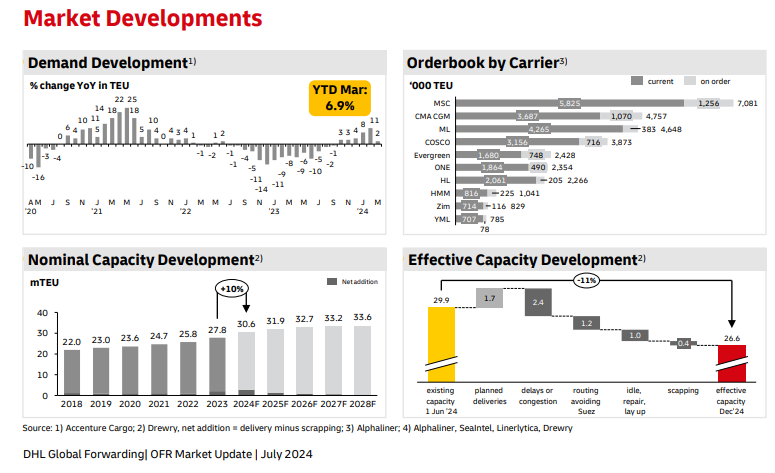

Capacity and Equipment Challenges

Carriers are struggling with equipment shortages and capacity management, influenced by supply-demand imbalances and geopolitical factors, leading to increased spot rates and operational challenges.

Port Congestion and Delays

Congestion at major transshipment ports in Asia, coupled with severe weather events, is causing significant delays and unreliability in shipping schedules, further exacerbating rate disparities.

Environmental Regulations and Compliance Costs

New environmental regulations are increasing operational costs, impacting freight rates and adding to the complexities faced by shippers and forwarders.

The widening gap between spot and contract rates is creating a challenging environment for freight forwarders, who are navigating increased costs, congestion, and regulatory pressures. The situation demands strategic adjustments to maintain efficiency and cost-effectiveness in the face of growing uncertainties.

Ocean Freight Trends for July 2024

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Middle East – Asia

Decreased cargo volume and ample space availability at Jebel Ali in early July with multiple sailings from lines like CUL/KMTC/ESL. Rates are expected to continue to decline next week from China to Middle East.

Capacity — (+)

Rate – (-)

Middle East – Europe

Port congestion in Europe is causing delays, but there will be available space in early July. The effects of congestion and increased yard utilization rates are putting upward pressure on shipping rates.

Capacity — (=)

Rate — (+)

Inbound Updates

Asia – Middle East

Port congestion affecting Asian ports of Singapore, Tanjung Pelepas, Port Klang, Shanghai, and Ningbo. Carriers report ships fully booked into July.

Capacity — (-)

Rate — (+)

North America – Middle East

Ongoing labor negotiations and increased volumes at U.S. West Coast ports are causing schedule unreliability and congestion at transshipment ports in Asia and some U.S. East Coast ports.

Capacity –(-)

Rate — (+)

Latin America – Middle East

The end of the port unions labor strike in Chile has increased cargo flow, but ongoing congestion and space shortages persist, particularly affecting ports like Santos, Rio Grande, Navegantes, Itapúa, and Paranaguá.

Capacity — (-)

Rate — (+)

Europe – Middle East

The Olympic Games in Paris from July 26 to September 8 are expected to cause disruption, congestion, and delays to shipments into and out of France.

Capacity — (-)

Rate — (+)

Air Freight Trends for July 2024

Demand: The global air cargo demand increased by 14%, mainly led by ASPA and MEA volume growth. The other factors contributing to the boost in air cargo volumes include global maritime shipping disruptions, increase in ecommerce expansion, rise in high-tech, perishable, and consumer goods.

Capacity: The global capacity has increased by 9% in May, fueled by the double-digit belly cargo growth in Northeast Asia. Overall capacity remains steady with constraints on key routes, including Asia to the US and Europe.

Rates: The global air freight rates rose in May due to strong demand for e-commerce and aggravated ocean freight disruptions. Furthermore, the rates are especially high on some routes, such as from Asia and Middle East origins to Europe.

The Middle East and Air Carriers

The air cargo volumes from the Middle East to Europe remain high due to the conflicts happening in the Middle East region. The flight to/from Saudi Arabia stays passenger centric, which is limiting the space for cargo shipments. Furthermore, many shippers are choosing a multimodal route through Dubai, leading to capacity shortage.

Asia

There has been a notable increase in the Southeast Asia and India volumes, alongside steady ecommerce levels from South China. This is amid the rise in the air cargo demand, boosted by the delays in sea freight. On the other hand, the capacity remains constrained for some trade lanes, including Asia to the US and EU. To manage the quarter-end demand surge, advanced bookings are required.

Lastly, the spot rates from Asia to Europe are rising, and the Asia to US rates remain high as well.

America

The CA inbound demand remains high, along with the 20% YoY increase in the demand from China. The US exports remain soft despite the annual rate increase. Furthermore, the inbound demand from AP has risen; along with IN to US high demand, tight capacity, and steep increase in rates. On the other hand, Sub-Saharan Africa is experiencing low volume and demand, which is leading to a more competitive market.

Europe

The economic growth expectation has improved from last month with market sentiments getting better in some countries. The rising ecommerce demand and the Red Sea situation resulted in higher import rates ex ASPA/MEA to Europe. Furthermore, the outbound Euro rates are stable and remain competitive in comparison to last year.

News Update on UAE Shipping – July 2024

CMA CGM has announced a new overweight surcharge for dry cargo from the Middle East Gulf to Europe, effective from July 6th, 2024. Read More

Effective July 1st , 2024, CMA CGM has announced new Port Congestion Surcharge (PCS) IN Paranaguá, Brazil. Read More

CMA CGM has updated their Peak Season Surcharges (PSS) from Turkey, Egypt, and Lebanon to West Africa. Read More

New Peak Season Surcharges (PSS) has been announced by CMA CGM from China to South Africa and Mauritius that became effective from 16th of June 2024. Read More

CMA CGM has enhanced their NWUK and SCUK services, effective from 21st June 2024. Read More

New Peak Season Surcharges (PSS) are applicable from all origins (except Asia) to US West Coast and Canada West Coast by CMA CGM. These charges will be effective from July 10th to October 31st, 2024. Read More

From July 1st, 2024, CMA CGM will update its BAF surcharge for Algeria, Tunisia, and Morocco RoRo services. Read More

CMA CGM has announced Port Congestion Surcharge (PCS) in Dammam, Saudi Arabia. Read More

New Peak Season Surcharge updated by CMA CGM from North Europe to Latin America. Read More

CMA CGM has announced rate adjustment, effective from 1st July 2024. Read More

New Peak Season Surcharges from India to South Africa announced by CMA CGM. Read More

New Peak Season Surcharges from India to West Africa announced by CMA CGM. Read More

Global Factory Output – Overview

The World Container Index (WCI) has increased by 4% for 40ft containers and now has reached $5,318.

United States of America (USA)

The weak demand from the domestic and export market has made the US manufacturers struggle in achieving strong production growth in June. Regardless of the PMI being positive in five out of six months of this year, the growth momentum has been very weak.

Business confidence has been at its lowest for 19 months, which suggests that the manufacturing sector is bracing itself to face tough times in the coming months.

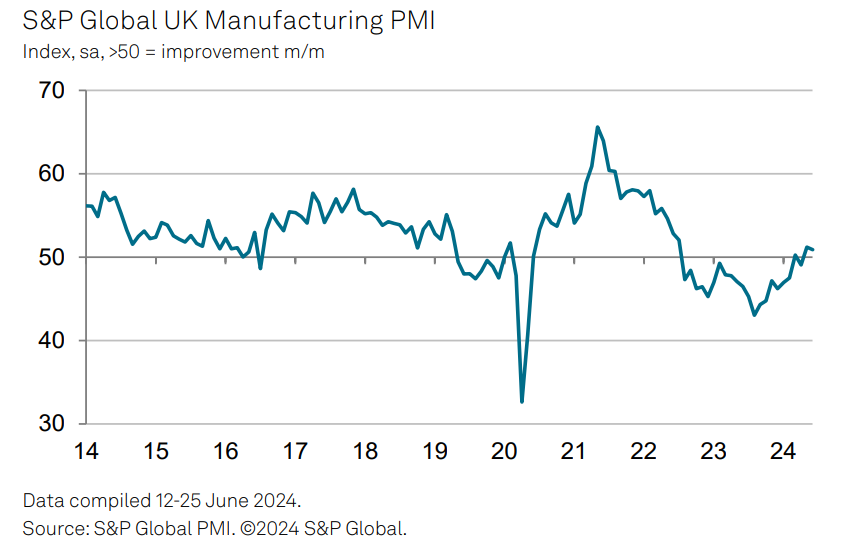

United Kingdom (UK)

The manufacturing sector in the UK has been enjoying the strongest growth spell for the last two years. The output and new order growth is sustained at robust rates in June, following the highs of May. The domestic market is performing well, providing a ripe source of new contract wins. Meanwhile, the ongoing poor export performance raises concerns, because the manufacturers are reporting difficulties in securing new business in key markets, cush as US, China, or the mainland Europe.

China

China’s manufacturing sector expanded midway into 2024. This was the fastest growth in two years due to the rising number of new orders. Furthermore, firms also secured more inputs for the support production, which led to higher stocks of purchases. For prices, the input cost inflation climbed to the highest from June 2022, causing the first increase in the average selling prices in this year.

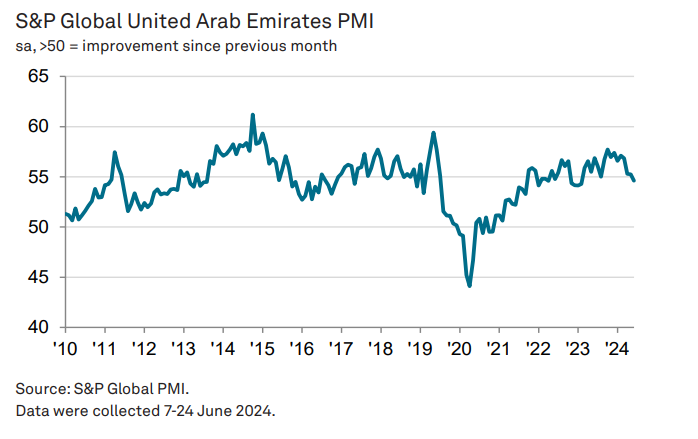

United Arab Emirates (UAE)

The latest PMI of the UAE indicates a slow growing trend in the non-oil sector throughout this year. However, the companies are still enjoying good customer demand and sturdy sales pipelines that are sustaining output expectations and driving purchasing activity.

Related Articles

Global Logistics and Shipping Update – June 2025

U.S. Revised Port Fee Regulations Impacting Chinese Maritime and Logistics Sectors The U.S. Trade Re

Global Logistics Market Update – May 2025

New Sulphur Emission Limits Enter into Effect in the Mediterranean The Mediterranean Sea officially

April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics Global Trade Disruptions & Rising Costs

Post a comment

You must be logged in to post a comment.