Al Sharqi September 2021 Ocean and Air Market Updates

The Supply Chain Issues Prevail!

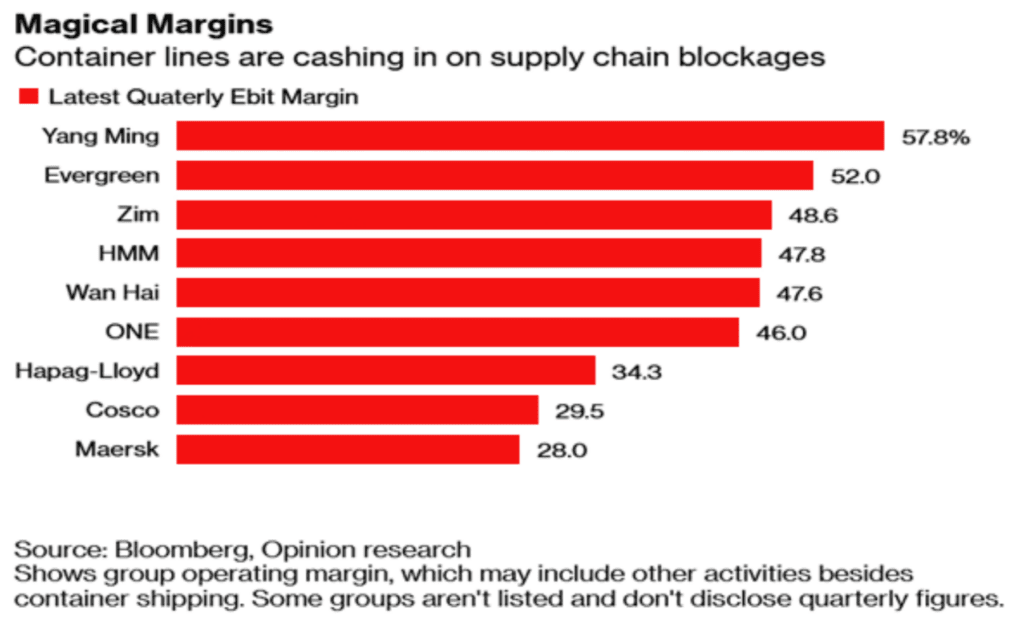

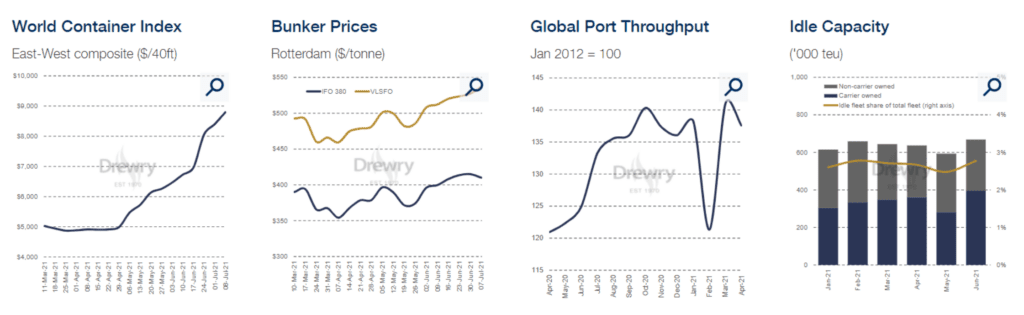

Almost all of Ocean Shipping Carrier’s profits are disclosed in the last quarter and after many years (almost a decade) they look finally to generate revenue.

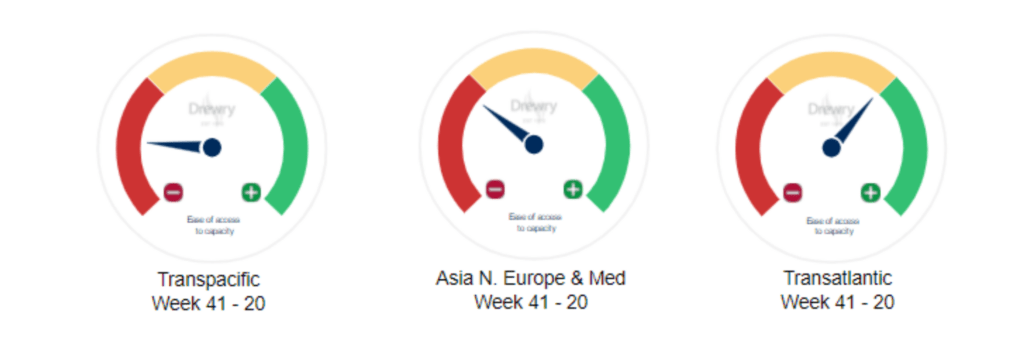

Despite the widespread belief that a cartel of some kind is being formed by the Ocean Shipping line, this is not true. Ocean carriers have hired and purchased extra vessels and have ordered extra equipment to refresh the hot freight market. This market is projected to remain through 2022.

September 2021 United Arab Emirates Sea Freight Market Updates

The Ocean Outbound Updates

Middle East → North America

One line Status The rates keep rising, All ocean carriers have applied PSS/GRI. Carriers do not release US East Coast reservations because of transshipment port congestion.

Local Rates

- Hapag implemented GRI on 1 September, a moderate increment from August 2021 (++)

- Hapag Lloyd increases GRI in the United States and Canada from Middle East on 15 September 2021.

Local Space Limited (-)

Local capacity/Equipment Limited but available on selected carrier (-)

Notes Bookings need to be made 2-3 weeks in advance

Middle East → Latin America

One line Status Because of restricted allocation, no ocean carriers are taking bookings as the sector. As before in the mid-term, the situation would stay unchanged.

Local Rates The prices are increasing generally (++)

- Hapag Lloyd increased the GRI from Middle East to East Coast of South America as of 15 August 2021.

Local Space Very tight (–)

Local capacity/Equipment (=)

Middle East → Europe

One line Status Increased prices, constrained space, and only premium rates are offered. Carriers like lightweight cargos.

Local Rates No increase from August (++)

- CMA CGM increased the prices from the Middle East to North Europe of freight of all kinds (FAK) on 1st September 2021

- CMA CGM increased Freight All Kind (FAK) from the Middle East Gulf to Northern Europe on September 16, 2021.

- Hapag Lloyd has increased Tariff Rates from the Middle East to North Europe on 15 September 2021.

- CMA CGM increased PSS in Northern Europe, Scandinavia, Poland, the Baltic, and the Black Sea on 16 September 2021.

Local Space reduced from August(–)

Local capacity/Equipment Equipment is available but reservations are restricted, but available on a premium on the specified carrier

Notes Bookings must be made 3-4 weeks in advance to secure

Middle East → Oceania

One line Status Costs are high from the United Arab Emirates

Local Rates (+)

Local Space (-)

Local capacity/Equipment (=)

Middle East → Africa

One line Status Rates and GRI are still increasing. In September the main carriers are fully reserved. Reservations for West Africa are only offered against “Sea Priority/Guarding on most routes in Africa, space is available at least 3-4 weeks in advance for bookings. Carrier’s allocation from GCC has been decreased. GRI implemented for East Africa look steady in the circumstances

Local Rates The prices are increasing generally (+)

- Hapag Lloyd increased GRI to East Africa from the UAE on 15 September 2021

- CMA CGM has notified FAK from the Middle East Gulf to North Africa effective September 16, 2021.

Local Space Critical and low in West Africa, particularly in East Africa

Local capacity/Equipment Limited available (-)

Notes Maersk Spot is reserved for two weeks in advance, and goods using “Shipping Guarantee” are given priority.

Middle East → China

One line Status Costs have risen due to a shortage of equipment for goods destined for Asia. Carriers prefer to transfer empty boxes rather than filled boxes to save turnaround time. The amount of free time at the destination has been reduced.

Local Rates The prices are increasing generally (++)

Local Space Tight Space (-)

Local capacity/Equipment available (=)

Middle East → Mediterranean MED

One line Status Rates are rising, space is scarce, and only premium-rate cargo is accepted.

Local Rates The prices are increasing generally (+)

- Hapag Lloyd increased Tariff Rates to the Mediterranean from the Middle East effective September 1st, 2021 through September 14th, 2021.

- CMA CGM has increased Freight All Kind (FAK) rates from the Middle East to the East Mediterranean, effective September 1st, 2021.

Local Space Limited but at a premium (-)

Local capacity/Equipment available

Middle East → ISC (Intra Gulf Service)

One line Status When compared to mid-term, equipment availability is consistent and rates are stable.

Local Rates The prices are increasing generally (+)

Local Space available (-/=)

Local capacity/Equipment available

Notes Bookings must be made at least 2-3 weeks in advance to ensure availability.

Middle East → Far East Asia

One line Status Costs have risen due to a shortage of equipment for goods destined for Asia. Carriers prefer to transfer empty boxes rather than filled boxes to save turnaround time. The amount of free time at the location has been lowered.

Local Rates The prices are increasing generally (++)

Local Space Limited Space (-)

Local capacity/Equipment available (=)

United Arab Emirates Inbound Ocean Market Updates

North America

One line Status The United States West Coast is still experiencing delays in Los Angeles, while both Oakland and Seattle have seen schedule delays and bunched-up sailings worsen in recent weeks.

Local Rates “One carrier” has set GRI for the middle of August, while others were targeting the first week of August.

Local Space Tight from USWest Coast. The United States East Coast is showing signs of progress in terms of accessible space. The amount of space accessible in the US Gulf has risen as capacity has become more easily available.

Local capacity/Equipment Capacity is most constrained from US West Coast. Most ports and ramps have limited space for equipment and chassis.

Notes Book 4+ weeks out

Latin America

One line Status Tight space, equipment issues, and structural service modifications all contribute to increases in Q3. Protests in Columbia decreased around the end of July, but the consequences on an already stretched market would be seen for some time. The port strike/closure in Durban jeopardizes the already precarious schedule integrity.

Local Rates Rate increases (+)

Local Space Critical (–)

Local capacity/Equipment (=)

Europe

One line Status With more blank sailings in August, space appears to be limited, and this trend appears to be continuing into September and October. Rates have generally been extended.

Local Rates Rates slightly increased (+)

Local Space Critical (–)

Local capacity/Equipment (-) getting better than August

Asia Pacific

One line Status Rates are typically continuing to rise as demand remains robust. The lack of new capacity release from schedule and congestion delays generates ongoing space stress.

Local Rates moderate increase (+)

Local Space Tight (-)

Local capacity/Equipment Under Capacity (-)

Indian Sub-Continent (ISC)

One line Status Carriers are re-aligning schedules by introducing blank sails. Equipment is a concern throughout India, and inland cargo facilities are also suffering from serious shortages.

Local Rates Rates increase (+)

- Hapag Lloyd increased Tariff Rates to the Mediterranean from ISC effective September 1st, 2021 through September 14th, 2021.

- Hapag Lloyd increased Tariff Rates to North Europe from ISC from September 1st, 2021 till September 14th, 2021.

- Hapag Lloyd increased a GRI from the Indian Subcontinent (ISC) and the Middle East to the United States and Canada, effective September 1, 2021, to September 14, 2021.

Local Space Tight (-)

Local capacity/Equipment (=)

Air Cargo Updates to the United Arab Emirates September 2021

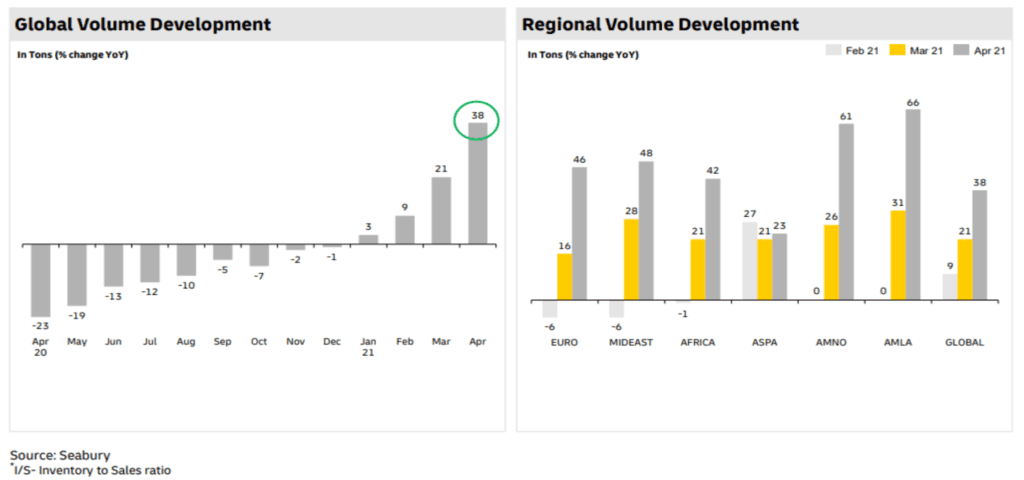

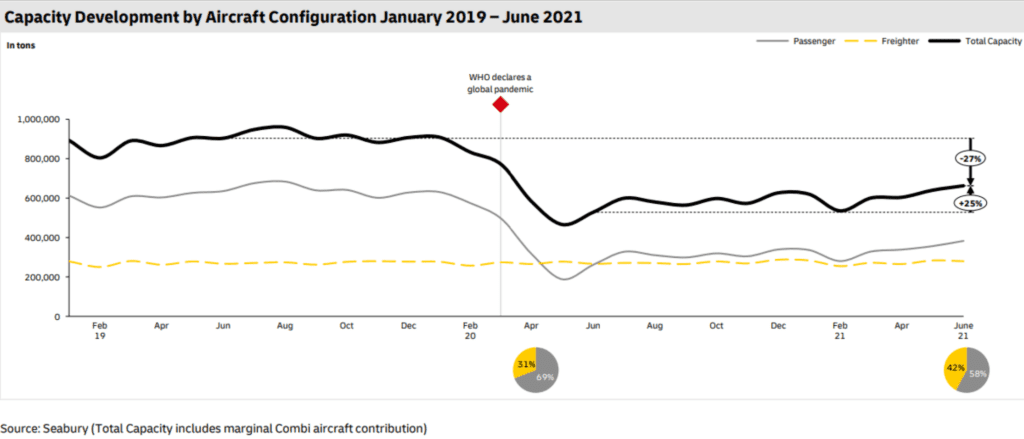

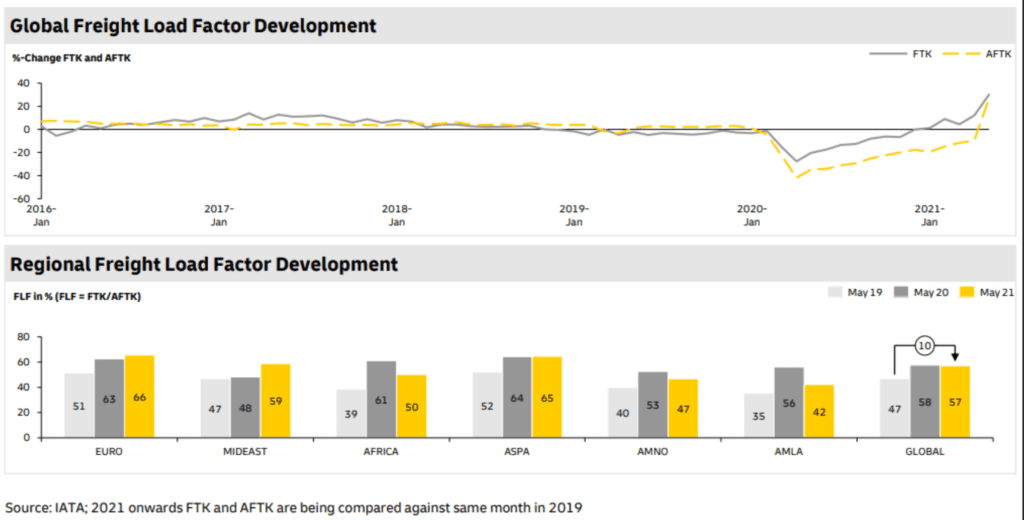

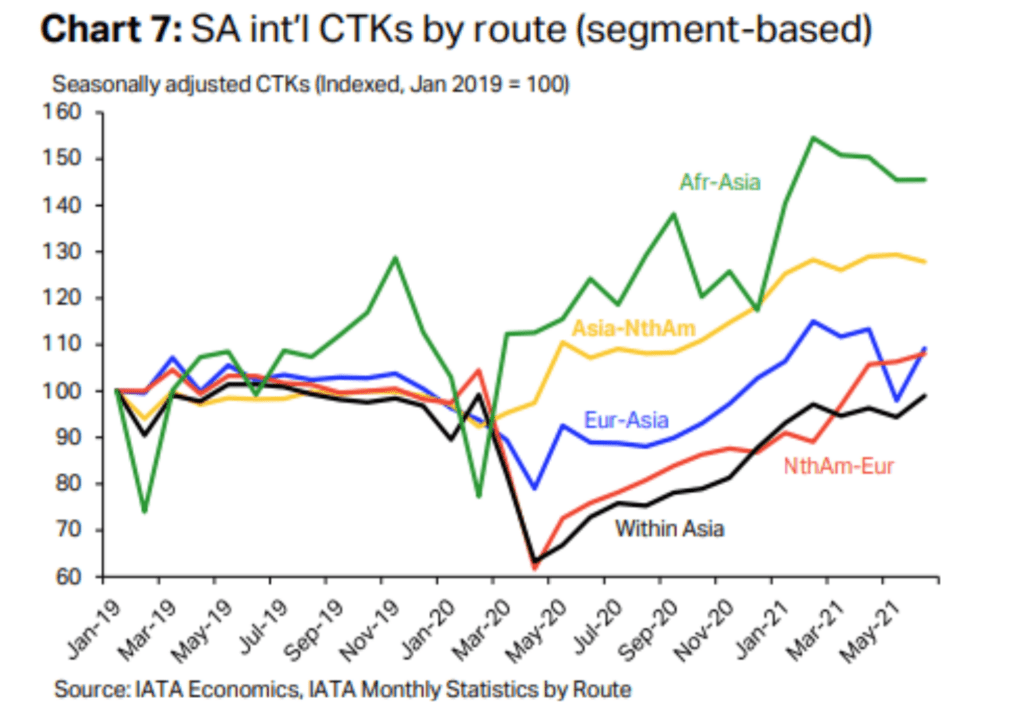

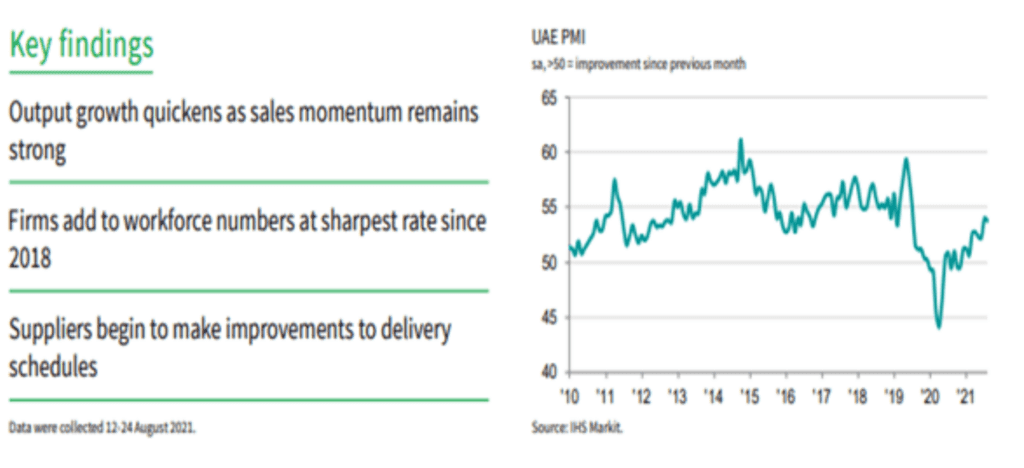

Air Freight Demand – demand growth still extends from hi-tech, high-value shipping to pharmaceuticals throughout many sectors. Ecommerce has also helped to generate strong demand. Port congestion, the exceptionally expensive sea rates on commerce in East and West, and the urgent re-establishment of seasonal inventories continue to transfer ocean-reliant cargo to air. Sustainable air freight demand growth is still projected in the robust PMI index.

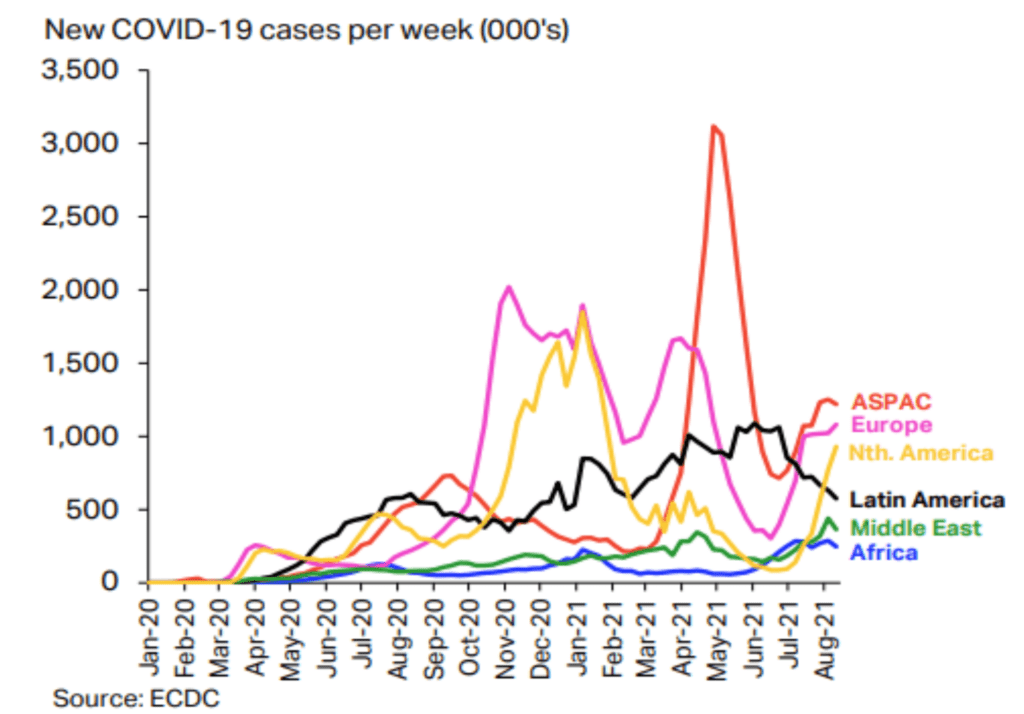

Carrier Capacity – Capacity growth looks to be considerably slower than demand, thus in the short-term rates and load factors will continue to be strong. In Europe and throughout other regions, the new wave of COVID restrictions might significantly impair the recovery speed in 2021, as capacity is limited. In the short term, it is not possible to get back the pre-pandemic competence.

Local rate – From May 2021 the freight rate steadily increased even though the air freight rates were up +80% in May 2021, and +7% above the peak in May 2019.

North America and South America

Freighters typically fly into Los Angeles and Houston, however, there is limited capacity. Limited freight aircraft operations in Miami. Only PAX flights have been affected; in San Diego, cargo terminals continue to be operational.

Although no major capacity has been constrained, the demand for exports from the US continues to be quite stable. Large shipments from all the main export gateways in the US might take 2-3 days to reach key European destinations when booked. Most airlines are declining to book flights because of their inadequate capacity. In the mid-term, in Latin America, the situation is expected to remain constant.

Europe

Airports in the UK operate routinely for freight, but with less staff, which impair efficiency. The restrictions on passenger flights are common; carriers operate routinely, though capacity is constrained. The economy of Turkey has significantly slowed. The office of Izmir was seriously impacted in terms of general business. Cargo terminals are operated routinely – there have been only disruptions to PAX planes. There is sufficient market capacity to satisfy this demand; expect a PAX injection from Great Britain that will open its borders to US/EU tourists properly vaccinated.

Asia

In August 2021, the impact of Typhoon In-Fa somewhat increased the PVG TPEB freight rate. In the remaining lanes and other major sources like HKG and TPE, market rates are comparable to last week.

The rest of Asia’s market conditions vary among countries and cities. Two countries are responding like. As an outcome of Samsung, there is limited HAN space in Vietnam, and SGN is still locked. In India, MAA has been locked down, whereas DEL’s manufacturing has been reopened.

Middle East and Air Carriers ME

In the United Arab Emirates, some flying restrictions for affected areas have been enforced. Freighters and Pax cargo flights are limited in their operation due to capacity limits. Cargo terminals operate often, although with a decreased staff performance. Terminals work routinely. No passenger aircraft are allowed to arrive or depart in KSA. Except for belly freight passengers.

In June 2021 compared to June 2019, Middle-East-based carriers recorded a 17.1% rise in their international air freight volumes, boosting significant ME Asia and ME-Nth Am trading lines.

United Arab Emirates Freight Local Updates, September 2021

September 2021 Logistics News Updates

Hapag Llyod has revised its Local Costs / Service Fees and Detention & Demurrage Effective October 1, 2021, Hapag Llyod’s local charges from the UAE will rise. Read More Here

Hapag Llyod has revised Regional Terminal Handling – Effective October 1, 2021, Hapag Llyod’s local terminal charges from the UAE will increase. Read More Here

MSC revises demurrage charges for all inbound cargo starting on September 1st, 2021, into Jebel Ali, Ajman, Fujairah, Sharjah, Khorfakkan, Ras Al Khaimah, and Umm Al Quwain ports.

Hapag Llyod has declared Heavy Lift Charges (HLC) for all Middle East commercial routes effective October 1, 2021. Read More Here

Hapag Llyod has notified an additional Marine Fuel Recovery (MFR) fee which is valid for both directions effective 1 October 2021 and which is presented as separate for your invoice and Bill of Lading. Read More Here

On the ODEX platform, Hapag Llyod offered its option to pay and provide quick confirmation of payment following payment of Hapag Llyod invoices. Read More Here

CMA CGM introduced a Cross Trade Shipments Late Payment Fee, effective 1 September 2021. Read More Here

CMA CGM has agreed to halt all spot rate increases beginning September 9, 2021, and lasting until February 1, 2022. Read More Here

GRI (general rate increase) to/from the Middle East

New GRI from Indian Subcontinent and the Middle East to Zanzibar, Tanzania by ESL on Sep 1 2021 Read More Here

New GRI from the Indian Subcontinent (ISC) and the Middle East to the USA and Canada by Hapag Llyod on Sep 15, 2021. Read More Here

New GRI from the Arabian Gulf to East Africa by Hapag Lloyd on Sep 15, 2021. Read More Here

New GRI from the Middle East and Indian Subcontinent to the East Coast of South America by Hapag Llyod on Sep 15, 2021. Read More Here

New GRI from the Middle East to the West of Africa and South Africa by Hapag Lloyd on Sep 15, 2021. Read More Here

New GRI from the Indian Subcontinent and the Middle East to the USA and Canada by Hapag Lloyd on Oct 1, 2021. Read More Here

Middle East PSS (Peak Season Surcharge)

The Peak Season Surcharges (PSS) for ECSA to North Europe, the Baltic Sea, the Mediterranean, North & West Africa, the Red Sea, Adriatic, Middle East, and India Subcontinent were announced by CMA CGM on September 1, 2021. Read More Here

Hapag Lloyd launched peak season surcharge (PSS) from Pakistan to Arabian Gulf ports effective 15 September 2021. Read More Here

Peak Season Surcharges (PSS) from India to destinations in the Middle East would be implemented from September 15, 2021, by Hapag Lloyd. Read More Here

Peak Season Surcharges (PSS) have been announced by CMA CGM from the Middle East Gulf to North Europe, Scandinavia, Poland, the Baltic, and the Black Sea are effective September 16, 2021. Read More Here

Peak Season Surcharges (PSS) from Pakistan to ports in the Arabian Gulf will be implemented on October 1, 2021, by Hapag Lloyd. Read More Here

Tariff Rates by Hapag Llyod

Hapag Llyod announced Tariff Rates for all goods transported in 20′ and 40′ General Purpose Containers (including High Cube Containers) from the Indian Subcontinent to the Mediterranean from September 1st, 2021 to September 14th, 2021. Read More Here

Hapag Llyod announced Tariff Rates for all goods transported in 20′ and 40′ General Purpose Containers (including High Cube Containers) from the Middle East and Pakistan to the Mediterranean from September 1st, 2021 to September 14th, 2021. Read More Here

Hapag Llyod announced Tariff Rates for all dry cargo transported in 20′ and 40′ general purpose containers (including high cube containers) from the Middle East and Pakistan to North Europe, effective September 15, 2021. Read More Here

Hapag Llyod announced Tariff Rates for all dry goods transported in 20′ and 40′ general purpose containers (including high cube containers) from Turkey to the Middle East and Indian Subcontinent starting October 1, 2021. Read More Here

FAK Rates By CMA CGM

CMA CGM increased Freight All Kinds (FAK) rates. Trade from the Middle East Gulf to North Europe and the East Med started on September 1st, 2021. Read More Here

CMA CGM increased Freight All Kinds (FAK) rates from the Middle East Gulf to North European, Scandinavian & Polish, and East Mediterranean Trades (W/B) from September 1st, 2021. Read More Here

CMA CGM increased Freight All Kinds (FAK) prices. From the Middle East Gulf to North Europe, the Mediterranean, and North Africa, as of September 16, 2021. Read More Here

September 2021 Factory Output News

Middle East

America

Sustainable growth of the US economy. In the second quarter, the actual GDP grew 6.5 percent a quarter (q/q) per year. Decreases in household investments, federal purchases, inventory, and net exports have somewhat offset a significant rise in consumer spending and fixed investment by firms.

By 2021, the real GDP forecast dropped by 0.5% to 6.1% and by 0.6% to 4.4% by 2022. The assessments indicated that growth has declined through 2021, with lower inventory investments in the setting of supply constraints and cautious consumer spending in reaction to COVID19 outbreaks.

Europe

Western Europe will continue to enhance growth driven by consumers. Decreased levels of COVID-19, labor-market gains, and household savings have resulted in an increase in consumption during the pandemic.

The European Central Bank’s new policy framework and guiding principles suggest a high level of monetary policy adjustment. The eurozone’s real GDP is expected to increase by 5.0% in 2021, 4.3% in 2022, and 2.1% in 2023 after a 6.4% decrease by 2020.

Asia

Mainland China’s long-term economic progress continues to deteriorate. Although the number of COVID 19 outbreaks is relatively small, the Chinese Government’s zero-tolerance approach has impacted business activity substantially.

The spread of the Delta variant is complicated by fairly limited progress in vaccination camps beyond mainland China. Consumption, tourism, industrial output, and exports have strongly affected the impacts. Pandemic production cuts have deteriorated Southeast Asia’s input and expenses. A semiconductor shortage led to further international automotive production cuts in August and September.

Exciting News this Month

Amazon plans to cut waste following backlash (cnbc.com)

For Robot Trucks, Navigating Highways Is Just One Bump in the Road – WSJ

Vietnam’s Supply Chain Role to Grow Despite Covid, U.S. Chamber Says | 2021-09-07 | SupplyChainBrain

Global Supply Squeeze, Delta Virus Rip Through Factories | 2021-09-03 | SupplyChainBrain

Container equipment prices double in the space of 12 months – Splash247

Why filling Father Christmas’s sack will cost more this year | The Spectator

Big retailers book pricey private cargo ships in holiday scramble (nbcnews.com)

Container Shipping Earnings Now Rival Apple. It’s Not a Good Look

Carriers are expected to set new financial records | Global Maritime Hub

Cost of Moving Cars Across the Ocean Is at a 13-Year High – Bloomberg

https://www.bloomberg.com/news/videos/2021-09-07/teledrive-a-step-before-autonomy-video

The shipping crisis is getting worse. Here’s what that means for holiday shopping (CNN)

Finance is squeezed by the ongoing rise in Air Freight (WSJ)

Walmart to launch delivery service for other businesses (AP)

Women Are Entering a Trucking Industry That’s Not Built for Them (Bloomberg)

McDonald’s runs out of milkshakes amid ‘supply chain issues’ (The Guardian)

Walmart charters ships to ensure freight capacity, inventory for peak season | Supply Chain Dive

Tight ocean market, peak preparations drive strong demand for airfreight | Supply Chain Dive

Air Cargo Boom in Supply Chain Crunch Has Car Tires Flying First Class – WSJ

Top toymakers say their products will be harder to find and more expensive this holiday season – CNN

Our customer service team is happy to assist you with planing your next booking.

Related Articles

April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics Global Trade Disruptions & Rising Costs

March 2025 Global Trade & Logistics Market Update

Ramadan 2025: Road Restrictions and Their Impact on Logistics in Abu Dhabi With Ramadan 2025 approac

Monthly Update on the Global Logistics Market – February 2025

Major Shifts in Carrier Alliances Reshape Global Shipping Dynamics 2025 marks a pivotal year in the

Post a comment

You must be logged in to post a comment.