UAE-Russia Trade Lane: Comprehensive Insights and Analysis

Introduction

The trade relationship between the UAE and Russia has grown substantially through strategic and economic initiatives. As both countries continue to expand their economic horizons, the UAE-Russia trade lane is now a critical component of their foreign trade policies.

Russia’s wealth in natural resources aligns well with the UAE’s strategic location and advanced logistics infrastructure. The UAE’s position as a global logistics hub also allows for efficient shipping from Dubai to Russia, enhancing the flow of goods and services between the two nations.

UAE and Russia: Key Economic Insights

Key Insights into the UAE's Economic Structure

The United Arab Emirates (UAE) boasts one of the most dynamic and diversified Middle East economies. In 2023, the UAE’s GDP was approximately $504 billion, with a real GDP growth of 3.6%. This growth was driven primarily by non-oil sectors, which grew by 5.0%, reflecting the UAE’s efforts to reduce its dependence on hydrocarbons and invest in other industries such as tourism, logistics, and financial services.

Industries Leading UAE’s Economic Growth

- Oil and Gas: Despite diversification efforts, oil and gas remain pivotal, contributing significantly to the UAE’s GDP and government revenues. The UAE is the seventh-largest oil producer in the world, with production levels of around 3 million barrels per day.

- Tourism: The UAE, particularly Dubai, is a top global destination, attracting over 16 million visitors annually.

- Aviation: Home to major airlines like Emirates and Etihad, the UAE’s aviation sector is crucial to its economy. Dubai International Airport is one of the busiest airports globally. The aviation sector also saw continued growth in 2023, with increased international travel.

- Logistics: Leveraging its strategic location, the UAE has developed world-class logistics and port facilities and has become a key transshipment hub for global trade.

Top Goods Exported by the UAE

The UAE’s top exports include crude oil, refined petroleum products, natural gas, aluminum, and petrochemicals. In 2023, the UAE exported approximately $400 billion worth of goods, with crude oil and related products accounting for nearly 40% of the total exports. The country is also a significant exporter of gold and diamonds.

Key Global Trade Partners of the UAE

The UAE’s major trading partners span across the globe, with significant trade relations with countries like China, India, the United States, Saudi Arabia, and Japan. China is the UAE’s largest trading partner, with bilateral trade exceeding $60 billion in 2023. India follows closely, with trade volumes around $45 billion.

Insights into Russia’s Economy

In 2024, Russia’s economy demonstrates resilience and growth despite global challenges. The GDP is projected to reach a year-end figure of $1.75 trillion.

Key sectors driving this growth include energy, technology, and agriculture. The energy sector, particularly oil and gas, continues to provide significant export revenues.

Russia’s Economic Landscape

Russia’s current market is robust, with a population of around 145 million and a growing consumer base. The economy is expected to grow at a rate of 2.8%, supported by strong performances in the energy, technology, and agricultural sectors.

The oil and gas industry continues to contribute significantly to the nation’s GDP and exports. Investments in technology and digitalization are also accelerating, with the government pushing for modernization across various sectors. Economic reforms aim to create a more favorable business environment, reduce inflation to approximately 4%, and stabilize the ruble.

Why Invest in Russia?

Economic Potential and Strategic Location

Russia is the world’s largest country by landmass, rich in natural resources, and strategically positioned between Europe and Asia. Its vast reserves of oil, gas, and minerals provide a strong foundation for economic growth. Additionally, Russia’s location offers significant advantages for trade, providing access to European, Asian, and Middle Eastern markets.

Natural Resources and Energy Sector

Russia is one of the world’s leading producers of oil and natural gas, making it a key player in the global energy market. The country’s abundant natural resources also include significant deposits of minerals such as gold, diamonds, and platinum. These resources contribute to a thriving energy and mining sector, attracting substantial foreign investment.

Growing Consumer Market

Russia boasts a large and diverse consumer market, with a population of over 140 million people. The rising middle class and increasing purchasing power create opportunities for businesses across various sectors, including retail, technology, and consumer goods. The country’s urban centers, such as Moscow and St. Petersburg, are particularly attractive for investors looking to tap into this expanding market.

Investment Incentives and Tax Benefits

The Russian government offers a range of incentives to attract foreign investment. These include tax benefits, subsidies, and grants for businesses operating in priority sectors such as technology, manufacturing, and agriculture. Special Economic Zones (SEZs) provide additional advantages, including reduced tax rates and simplified regulatory procedures, making Russia an appealing destination for foreign investors.

Infrastructure Development and Innovation

Russia is investing heavily in infrastructure development, including transportation, telecommunications, and digital technology. The government’s focus on modernizing infrastructure and promoting innovation is driving growth in sectors like logistics, IT, and fintech. Additionally, Russia’s skilled workforce and strong educational system support a growing tech industry, further enhancing its appeal to international investors.

Stable Political Environment

Despite geopolitical challenges, Russia maintains a relatively stable political environment, with a government committed to economic growth and development. The country’s legal framework for foreign investment has been strengthened in recent years, providing more protection and clarity for investors. This stability, combined with Russia’s natural resources and consumer market, makes it a compelling destination for investment.

Overview of the UAE-Russia Trade Corridor

Major Industries Driving UAE-Russia Trade

The UAE relies on Russian energy resources, particularly oil and natural gas, to meet its domestic and regional energy demands. Conversely, Russia imports advanced technologies, financial services, and consumer goods from the UAE, which boasts a diversified and innovation-driven economy.

The agricultural sector also plays a significant role, with the UAE importing Russian grains, meat, and dairy products, ensuring food security and diversifying its food sources.

Top Commodities Exchanged in UAE-Russia Trade

Primary exports from Russia to the UAE encompass oil, natural gas, and agricultural products such as wheat and meat. These resources drive the UAE’s energy sector and food security strategies.

On the other hand, the UAE exports to Russia include high-tech machinery, electronics, luxury goods, and construction materials. This balanced trade relationship promotes economic stability and mutual growth.

Primary Trading Partners in the UAE-Russia Trade Lane

The UAE and Russia engage with several key international trading partners within this trade lane. Notable partners include China, India, and European Union countries, which are integral to the broader trade network.

Key Shipping Routes and Transport Methods

Mapping Major Transport Corridors

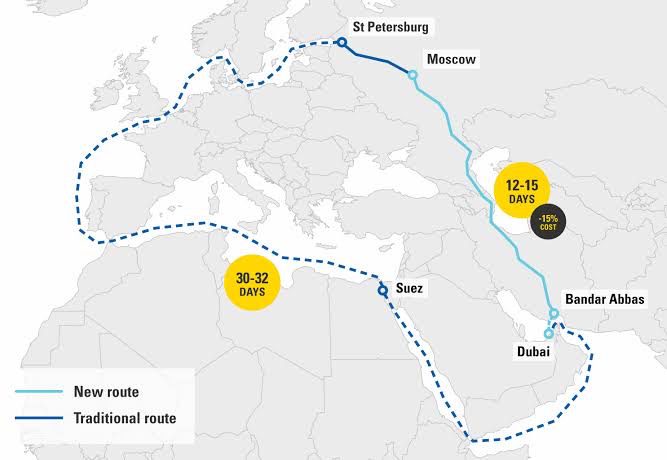

Key Transport Corridors to Russia

The UAE-Russia trade lane features several essential transport corridors:

- Maritime Routes: The Persian Gulf to the Black Sea route mainly transports bulk commodities like oil and gas. This route efficiently moves large volumes of goods, leveraging the UAE’s advanced port facilities and Russia’s strategic Black Sea ports.

- North-South Transport Corridor (NSTC): This rail and road network links the UAE with Russia through Iran and Azerbaijan. The NSTC reduces transit times and costs, enabling faster and more cost-effective trade between the two nations.

Key Shipping Routes Linking UAE and Russia

Sea Freight Details

Sea freight, in the UAE-Russia trade, handles the bulk transport of oil, natural gas, and agricultural products. This transport mode is favored for its capacity to move large volumes efficiently and cost-effectively, such as international car shipping services to Russia, utilizing advanced port facilities and shipping technologies.

Main Shipping Routes between UAE and Russia

The primary shipping from Dubai to Russia route involve maritime transit from the Persian Gulf through the Suez Canal, across the Mediterranean Sea, and into the Black Sea, reaching Russian ports like Novorossiysk.

Another vital route runs from the UAE through the Indian Ocean, around the Cape of Good Hope, and up to Russian ports in the Baltic Sea, such as Saint Petersburg. Transit times for these routes typically range from 20 to 30 days, depending on weather conditions and port processing efficiencies.

Air Freight Details

Air transport is particularly beneficial for goods that require expedited handling, such as high-tech electronics, luxury items, and perishable agricultural products.

Flight services ensure to transport these goods quickly, maintaining their quality and market value. Air freight to Russia also supports the smooth flow of trade during peak seasons and in situations where maritime shipping might face delays.

Transit times for air freight between the UAE and Russia typically range from 5 to 10 hours, depending on the specific routes and logistics arrangements.

Major Ports in UAE-Russia Trade Lane

Key maritime ports in the UAE include Jebel Ali Port and Khalifa Port, both renowned for their state-of-the-art infrastructure and high handling capacities. Jebel Ali Port, the largest in the Middle East, supports international shipping and logistics. Khalifa Port complements this capacity with its advanced container handling capabilities.

In Russia, major ports include Novorossiysk and Saint Petersburg. Novorossiysk, located on the Black Sea, is a principal gateway for Russian exports, particularly oil and grain. Saint Petersburg, the largest port in Russia, supports the export of energy products and imported goods to Europe and beyond.

Key Airports and Airlines

In the UAE, Dubai International Airport (DXB) and Zayed International Airport (AUH) are the primary airports. DXB, being one of the busiest airports globally, offers extensive cargo handling facilities and connections. AUH is known for its state-of-the-art logistics infrastructure.

In Russia, Sheremetyevo International Airport (SVO) in Moscow and Pulkovo Airport (LED) in Saint Petersburg are the main cargo hubs. SVO, as Russia’s largest airport, provides extensive cargo services and robust connectivity with international destinations. LED supports significant cargo operations, particularly for goods destined for Northern and Western Russia.

Leading airlines operating on this route include Emirates SkyCargo, Etihad Cargo, Aeroflot Cargo, and AirBridgeCargo. Emirates SkyCargo and Etihad Cargo, based in the UAE, offer extensive global networks and specialized cargo services. Aeroflot Cargo and AirBridgeCargo are prominent Russian carriers delivering seamless cargo service to Russia and beyond.

Customs and Regulations

A Guide to Russia’s Customs Procedures

Key Requirements for Export Compliance

Exporting goods from Russia requires several key documents: a commercial invoice, packing list, export declaration, certificate of origin, and any necessary permits or licenses depending on the nature of the goods. These documents align exports with all legal and regulatory requirements, facilitating smooth transactions and avoiding potential delays.

Essential Guidelines for Importing into Russia

Import regulations in Russia encompass various tariffs, Value-Added Tax (VAT), and customs duties applicable to imported goods.

Tariffs range from 0% to 20%, depending on the product category. Most goods are also subject to a standard VAT rate of 20%, with certain essential items qualifying for reduced rates. Specific goods, such as alcohol and tobacco, also incur excise duties. Importers must comply with technical regulations and standards, including product certification and conformity assessments.

Key Requirements for Import Documentation

Importing goods into Russia necessitates several critical documents: a commercial invoice, packing list, bill of lading or airway bill, import declaration, certificate of conformity (if applicable), and any necessary permits or licenses.

Understanding UAE Customs Procedures

Preparing Required Documents for Export

Exporting goods from the UAE requires several essential documents:

- Commercial Invoice: Details the transaction, including the value of goods and terms of sale.

- Packing List: Provides information on the contents of the shipment, including weight and dimensions.

- Certificate of Origin: Certifies the origin of the goods, often required by the importing country.

- Export Declaration: Submitted to customs authorities for clearance.

- Permits and Licenses: Required for specific goods, such as those considered dual-use or restricted.

Key Regulations for Exporting from the UAE

Export tariffs are generally low, and free trade zones offer exemptions from export duties. Still, exporters must adhere to export control regulations, which may require obtaining licenses for certain goods. Compliance with international trade agreements and sanctions is also mandatory.

Key Compliance Rules for UAE Imports

Import tariffs in the UAE range from 0% to 5% for most goods, with higher rates applied to specific items. A standard VAT of 5% is levied on most imported goods.

Importers must also adhere to product standards, safety, and labeling requirements, ensuring that goods meet the UAE’s quality and safety standards.

Preparing Import Documents

Importing goods into the UAE requires several key documents:

- Commercial Invoice: Details the transaction and the value of the goods.

- Packing List: Outlines the contents of the shipment, including weight and dimensions.

- Bill of Lading or Airway Bill: Proof of shipment, essential for tracking and customs clearance.

- Import Declaration: Necessary for customs clearance.

- Certificate of Conformity: Ensures that goods meet UAE regulatory standards.

Trade Growth: Key Opportunities and Hurdles

Exploring Trade Opportunities

The trade relationship between the UAE and Russia is ripe with opportunities. Currently, both countries are actively seeking to enhance their trade ties through comprehensive agreements and collaborations.

The UAE, leveraging its state-of-the-art logistics and infrastructure, connects Russian exports to the Middle East, Africa, and Asia. Conversely, Russia’s vast natural resources and expanding technological sector present significant opportunities for UAE businesses.

High-Growth Sectors to Watch

Several industries in the UAE and Russia demonstrate substantial growth potential:

- Energy: Russia’s oil and gas reserves complement the UAE’s investments in energy infrastructure, including renewable energy projects.

- Technology: The UAE’s focus on innovation and digital transformation aligns with Russia’s strengths in technology, cybersecurity, and software development.

- Agriculture: The UAE imports significant quantities of Russian agricultural products, including grains and meat. Investment in AgriTech can enhance food security and boost agricultural productivity.

- Tourism: Initiatives to promote tourism between the two nations, including visa facilitation and direct flights, will increase tourist flow and investment in hospitality sectors.

Trade Agreements Enhancing Bilateral Trade

The UAE-Russia Strategic Partnership Agreement focuses on enhancing cooperation across energy, finance, and technology sectors. Additionally, MoUs aimed at fostering innovation, investment, and economic diversification have been established. These agreements streamline trade processes, reduce tariffs, and promote joint ventures, thereby significantly boosting bilateral economic activities.

High-Growth Markets in UAE-Russia Trade

Emerging markets in both countries are creating new opportunities:

- In the UAE: The fintech sector is experiencing rapid growth due to supportive regulations and a tech-savvy population. Renewable energy projects, particularly solar and wind, are also receiving considerable attention and investment.

- In Russia: E-commerce is booming, driven by increased internet penetration and consumer demand. The cybersecurity sector is also growing, leveraging Russia’s strong tech expertise.

Tackling Key Trade Challenges

Language and Cultural Barriers

Arabic is the primary language in the UAE, while Russian is predominantly spoken in Russia. This language disparity can lead to miscommunications and misunderstandings in business transactions. Additionally, cultural differences in business etiquette, negotiation styles, and consumer preferences can impact effective shipping to Russia.

Addressing these challenges involves investing in language training, employing bilingual staff, and driving cultural awareness through exchange programs and workshops.

Political Instability

The imposition of international sanctions on Russia, fluctuating diplomatic relations, and regional conflicts create an unpredictable trade environment. Resulting effects are trade restrictions, increased compliance costs, and volatile market conditions.

Therefore, businesses must stay informed about the political landscape. Best practices include diversifying trade routes, exploring alternative markets, and establishing robust contingency plans to navigate political uncertainties and maintain trade continuity.

Infrastructure Challenges

In Russia, severe weather conditions, outdated transportation networks, and logistical bottlenecks can delay shipments and increase costs. The Trans-Siberian Railway, while crucial, requires modernization to enhance efficiency.

In the UAE, while the infrastructure is advanced, the reliance on specific maritime routes, such as the Strait of Hormuz, can create vulnerabilities. Addressing these challenges requires strategic investments in infrastructure improvements.

Al Sharqi's Enhanced Services for the UAE-Russia Trade Lane

At Al Sharqi, we provide comprehensive logistics solutions tailored for UAE-Russia trade, leveraging our extensive network. Our expertise in both ocean and air freight ensures reliable and efficient transportation of goods.

Special Services for Cargo to Russia

We offer specialized services for shipping from Dubai to Russia. Our customs brokerage complies with all global regulatory requirements, while our warehousing offers secure and flexible storage.

Unique to our offering is the Air Cargo Charter Service to Russia, providing dedicated flights for urgent or oversized shipments. This service streamlines our logistics solutions to meet tight deadlines and specific transport needs.

Partner with Al Sharqi to optimize your UAE-Russia trade operations. Our specialized freight forwarding, and unique air cargo charter services ensure secure, efficient transportation. Enhance your supply chain with our comprehensive logistics solutions.

Contact us today to get started!

Conclusion

The UAE-Russia trade lane features significant economic partnerships and strategic trade agreements. Al Sharqi facilitates this trade partnership through comprehensive logistics services, including specialized freight forwarding and air cargo charters, ensuring efficient transport between the two nations.

Currently, the UAE-Russia trade lane will grow substantially, with continuous efforts to enhance bilateral ties and improve infrastructure. Emerging markets and technological advancements will drive future development and economic cooperation.

FAQ's

Russia exports grains, meat, and precious metals, while the UAE exports consumer goods and high-tech products.

Trade between the UAE and Russia reached $10 billion in 2023, making the UAE Russia’s largest Arab trading partner.

Challenges include language barriers, geopolitical tensions, and infrastructure issues. These require bilingual professionals, risk mitigation strategies, and investments in transportation networks.

Sanctions on Russia create market volatility and increase compliance costs, requiring businesses to diversify supply chains and explore alternative markets.

Opportunities in energy, technology, agriculture, and tourism are enhanced by advanced logistics in the UAE and Russia’s natural resources and technological advancements.

Related Articles

Comprehensive Analysis of UAE-Ukraine Trade Relations

Introduction The trade lane between the UAE and Ukraine has gained substantial momentum, particularl

UAE-Russia Trade Lane: Comprehensive Insights and Analysis

Introduction The trade relationship between the UAE and Russia has grown substantially through strat

Trade Relations Between UAE and Georgia – A Comprehensive Overview

The trade relationship between the United Arab Emirates (UAE) and Georgia has seen remarkable growth

Post a comment

You must be logged in to post a comment.