VAT FAQ UAE 2018

If you are unable to find an answer to your specific query, please visit the website of the UAE Federal Tax Authority (FTA) at www.tax.gov.ae.

What is VAT?

VAT stands for Value Added Tax, it is an indirect tax applicable to taxable goods and services in the UAE.

When will VAT be implemented?

VAT will be introduced across the UAE on 1 January 2018.

How should I register for VAT?

Registration for VAT is done directly with the UAE Federal Tax Authority (FTA) through their website www.tax.gov.ae. Each company should verify if it is required to register for VAT in accordance with the conditions set out in the Federal Decree-Law No. (8) of 2017 on Value Added Tax.

Is it possible to register for VAT as a tax group?

The conditions for tax grouping are set out in the Federal Decree-Law No. (8) of 2017 on Value Added Tax. This can be accessed through the website of the FTA.

If a Company is registered with Customs does it still need to register with the FTA for VAT?

Yes, registration requirements are separate. You will need to check if registration for VAT is also required for your business. The FTA states the mandatory and voluntary registration conditions on their website. Go to https://www.tax.gov.ae/en/faqs

Part of the registration process for VAT requires that you provide a ‘to whom it may concern’ letter from Customs. You can obtain this letter through an online request using the Dubai Trade Portal at www.dubaitrade.ae.

Do the VAT registration requirements apply to Free Zone companies?

Yes, each company should verify if it is required to register for VAT in accordance with the conditions set out in the Federal Decree-Law No. (8) of 2017 on Value Added Tax.

All companies in UAE are required to register with FTA for TRN number but for a free zone where companies are are based inside the Free Zone that are considered as designated zones are exempted from VAT.

As a customer, do we need to provide our ‘Tax Registration Number (TRN)’ to Port Authority?

Yes, once you receive your TRN you are required to provide it to them. This is important to update your account details and ensure that your TRN is reflected on our invoice. In order to claim back VAT (if applicable) your TRN needs to be displayed on the invoice.

How can I share my TRN with you?

If you are a customer, your TRN and VAT certificate copy should be added to the ‘VAT Customer Profile’ service on Dubai Trade Portal (www.dubaitrade.ae).

Alternatively, Al Sharqi Shipping can walk you through with each of the Authorities and update TRN on behalf of its customer.

What is a Designated Zone for VAT?

A Designated Zone is a term used in the UAE to describe a specified area that is considered outside the UAE for VAT purposes, in some scenarios. Some of the conditions of Designated Zones include that the zone must be a specific fenced geographic area and have security measures and Customs controls in place to monitor entry and exit of individuals and movements of goods to and from the area. There are other conditions, however, areas that are to be treated as Designated Zones will be specified by a decision of the Cabinet.

Will Free Zone be a Designated Zone for VAT?

Free Zone meets the conditions required to be a Designated Zone as set out in Cabinet Decision No. (52) of 2017 on the Executive Regulations of the Federal Decree-Law No (8) of 2017 on Value Added Tax, however, the Cabinet Decision has confirm the list of areas treated as Designated Zones as mentioned on the recent blog.

Are there special VAT rules for Designated Zones?

Free Zone meets the conditions required to be a Designated Zone as set out in Cabinet Decision No. (52) of 2017 on the Executive Regulations of the Federal Decree-Law No (8) of 2017 on Value Added Tax, however, the Cabinet Decision has confirm the list of areas treated as Designated Zones.

There are some special rules for goods supplied within Designated Zones. Goods for consumption are not included in these special rules. There are no special rules for services in relation to the Designated Zones. These rules are contained in Cabinet Decision No. (52) of 2017 on the Executive Regulations of the Federal Decree-Law No (8) of 2017 on Value Added Tax. The Executive Regulations are available on the FTA website.

What will be the applicable VAT rates on DP World supplies?

VAT is applicable to the services provided by DP World. This could be at the 5% or 0% rate or it could be that the supplies exempt or out of the scope of UAE VAT. The relevant VAT treatment for each service will be applied in accordance with the Federal Decree-Law No. (8) of 2017 on Value Added Tax and the Cabinet Decision No. (52) of 2017 on the Executive Regulations of the Federal Decree-Law No (8) of 2017 on Value Added Tax.

Will VAT apply to tenancy contracts for commercial property?

In principle, the lease of commercial property in the UAE is subject to VAT at 5%.

There is special rule applying to supply of goods, including commercial tenancy contracts, within a Designated Zone which could result in VAT not being applicable to a commercial property lease within the Designated Zone. Refer to the answer to the question ‘Will Jafza be a designated zone for VAT?‘ above.

Will there be a new tariff published by DPW in lieu of changes to VAT effective 2018?

No, the DP World Tariff shall remain as is. However, VAT will be charged in addition to the Tariff rates for taxable services in accordance with the VAT legislation. Refer to the DP World circular reference DPW/233/2017 dated 5th of November 2017.

Which DP World services are taxable?

Many of DP World UAE Region FZE’s services are services related international transport of goods or passengers. As such, these services will be zero-rated for VAT (taxable at 0%) in accordance with Article (45) Clause (2) of the Federal Decree-Law No. (8) of 2017 on Value Added Tax. Local transportation services, however, will be taxable at 5%. Non-transportation services will be treated in accordance with the Federal Decree-Law No. (8) of 2017 on Value Added Tax and could be taxable at 5%.

How can I get more information on VAT and how it applies to me?

Please note that Al Sharqi Shipping cannot provide input on your personal VAT position. You should check the VAT legislation, the website of the FTA or seek advice from a VAT professional services provider. The website of the UAE Federal Tax Authority (FTA) can be found at www.tax.gov.ae.

Our customer service team is happy to assist you with planing your next booking.

Related Articles

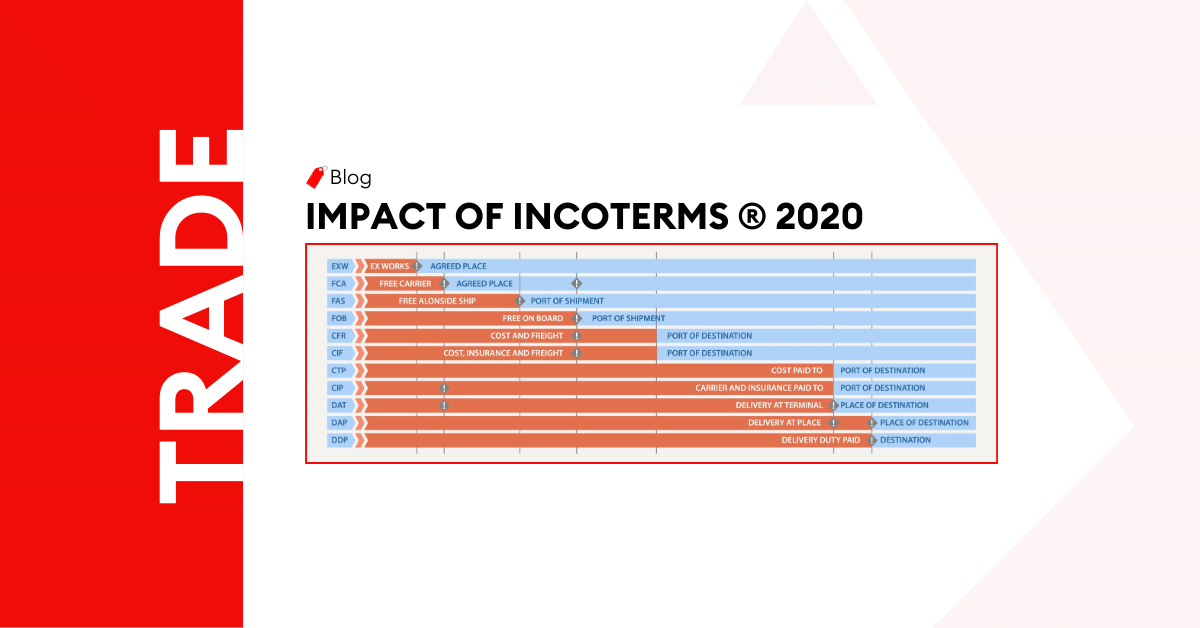

The Impact of Incoterms ® 2020 on Global Trade Explained

Understanding the incoterms is essential if you are shipping goods. These are the rules of commercia

Understanding the Different Types of Free Zones in the UAE

Introduction In the dynamic landscape of the United Arab Emirates (UAE), the concept of free zones h

UAE Free Zone vs. Mainland: Which One is Right for Your Business?

Introduction In the vibrant landscape of the United Arab Emirates, aspiring entrepreneurs often find

Post a comment

You must be logged in to post a comment.