Freight and Logistics Market Update – October 2024 Overview

What’s Driving the Freight Market in Q4 2024?

As we move into the final quarter of 2024, the freight industry faces a mix of opportunities and challenges. From easing inflation to potential disruptions, businesses must stay alert to market shifts to optimize their operations.

Inflation Eases, Offering Relief

nflation rates have dropped to 2.5% as of August 2024, the lowest since 2021. This trend offers some cost relief, benefiting logistics operations as cost pressures ease.

Fuel Prices Stabilize

After a mid-year increase, diesel prices have leveled off at $3.544 per gallon, which could help control transportation costs.

Freight Demand Remains Low

Despite low demand persisting throughout the longest freight recession, the upcoming holiday season might provide a temporary boost in shipment volumes.

Disruptions to Watch

The ongoing hurricane season and potential strikes at U.S. East and Gulf Coast ports could create further delays in freight schedules, impacting supply chains.

Ocean Freight Market Trends – October 2024 Update

Key | |

++ | Strong Increase |

+ | Moderate Increase |

= | No Change |

– | Moderate Decline |

— | Strong Decline |

Outbound

Inbound Updates

Asia – Middle East

Outbound capacity is facing moderate declines, driven by high demand, while rates are increasing due to the constrained availability of shipping slots.

Capacity — (-)

Rate — (+)

Latin America – Middle East

Outbound capacity from Latin America is facing moderate declines as demand outpaces available shipping space, leading to moderate rate increases.

Capacity — (-)

Rate — (+)

Europe – Middle East

Outbound capacity from Europe is seeing slight constraints due to operational challenges, leading to a moderate increase in shipping rates.

Capacity — (-)

Rate — (+)

Air Freight Market Developments – October 2024

Demand: Air cargo demand saw significant growth in September, with a +4% increase driven by strong tonnage rises from Asia-Pacific, Central/South America, and North America.

Capacity: Capacity increased notably on routes like Dubai to the U.S., where tonnage surged by +50% in September.

Rates: Worldwide air freight rates are up +14% year-on-year, with rates in regions like Asia-Pacific and MESA seeing sharp increases, while North America and Europe faced a slight decline.

The Middle East and Air Carriers

The air cargo sector in the Middle East is facing severe disruptions due to escalating conflicts in the region. Airspace closures in Israel, Lebanon, and surrounding areas have forced many airlines, including FedEx and Turkish Airlines, to suspend services. This has caused delays in essential deliveries and a backlog of cargo at major airports. The geopolitical situation is significantly impacting logistics, with further disruptions expected as the conflict continues to unfold.

Asia

Air freight demand across the Asia-Pacific region is surging due to preparations for the peak season, resulting in tight capacity on key routes. This elevated demand is driving significant increases in rates, particularly in regions affected by operational disruptions. Despite current challenges, capacity adjustments by carriers are expected to bring some relief in the coming months. Businesses should prepare for continued elevated rates as the year progresses.

America

Air freight demand in Latin America remains high, leading to constrained capacity and rising rates. As peak season approaches, shippers should anticipate further rate increases and potential delays. Early booking is recommended to manage these challenges.

Global air freight demand surged by 13% year-over-year, driven by e-commerce and ocean-to-air substitution. However, with only a 2% increase in capacity, certain routes are experiencing tight conditions. The disruptions in the Red Sea region have further increased reliance on air freight, making it crucial for businesses navigating supply chain challenges.

Europe

Air freight demand remains strong, particularly for routes from Asia to Europe, driven by the approaching peak season and e-commerce growth. Rates from Europe are competitive, but capacity from Asia is tightening due to ongoing disruptions and high demand. The addition of new Maersk Boeing 777F aircraft is expected to provide some relief and enhance service on key routes between Europe and China.

UAE Shipping Sector Insights – October 2024

Maersk announces upcoming changes due to a financial system upgrade to SAP S/4HANA in October 2024.

Maersk announces changes to invoice and credit note titles for South Africa and Ghana, effective from 8 October 2024.

Maersk announces a change in invoicing processes for Africa exports in-transit shipments, effective 8 October 2024.

Hapag-Lloyd updates Detention and Demurrage billing policies amid potential U.S. port closures due to a strike, with specific guidelines for import/export shipments. Read More

U.S. Customs and Border Protection (CBP) announces new cargo description requirements for air shipments, effective 7 October 2024. Read More

CMA CGM announces administrative fees for post-invoice changes, including payer adjustments and waybill cancellations. Read More

CMA CGM introduces an Overweight Surcharge (OWS) for dry cargo from India, Sri Lanka, Middle East Gulf, and Djibouti to Europe, effective October 1, 2024. Read More

Maersk announces an update on Import Service (IMP) from the world to South Africa, effective 1 October 2024. Read More

Maersk announces a revision of OHC/DHC charges to/from Mozambique, effective 1 October 2024. Read More

CMA CGM announces updates to streamline the Seaway Bill of Lading (SWBL) release process, effective 1st October 2024. Read More

Hapag-Lloyd provides weekly updates on services, operations, rates, and surcharges, including adjustments for Golden Week shipping. Read more

CMA CGM announces an Overweight Surcharge (OWS) for dry cargo from Türkiye Med and Egypt Med to East Africa and Comoro Islands, effective September 18, 2024. Read More

CMA CGM announces updated local port charges for US East Coast and US Gulf imports/exports, effective October 11, 2024. Read More

Maersk announces a Fuel Surcharge adjustment (SAI) effective 1 November 2024. Read More

Global Factory Output – Overview

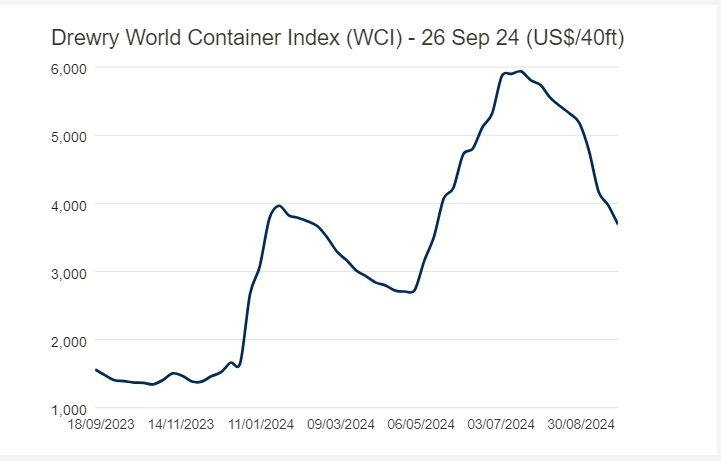

The World Container Index (WCI) has decreased by 7% and now has reached $3,691 per 40-ft container.

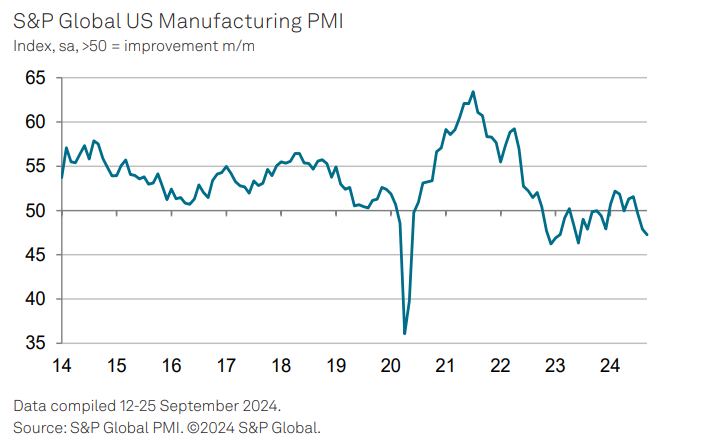

United States of America (USA)

The September PMI survey shows a significant decline in US factory production, the largest in 15 months, due to a drop in new orders, leading to reduced employment and input purchases. However, businesses expect this demand slump to be temporary, tied to election uncertainty, with optimism rising due to potential lower interest rates. While cost pressures remain low, geopolitical risks could push energy prices and inflation higher.

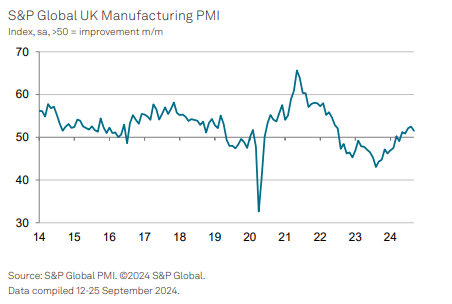

United Kingdom (UK)

UK manufacturing continues to grow, though at a slower pace, with output rising for the fifth straight month in September. However, business confidence has dropped to a nine-month low due to uncertainty around government policy and global economic risks. Inflationary pressures are also mounting, with input costs hitting a 20-month high, driven by rising freight costs and ongoing supply chain disruptions.

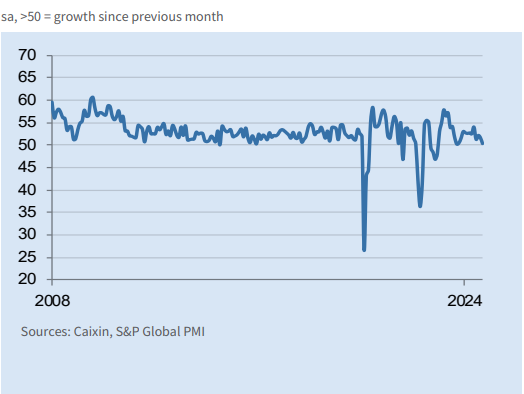

China

China’s service sector growth slowed in September 2024, with only marginal increases in new business despite solid export growth. Rising demand caused backlogs and modest hiring. Optimism fell as input costs surged, but firms were reluctant to raise prices. The Caixin Services PMI dropped to 50.3, marking the slowest expansion in a year.

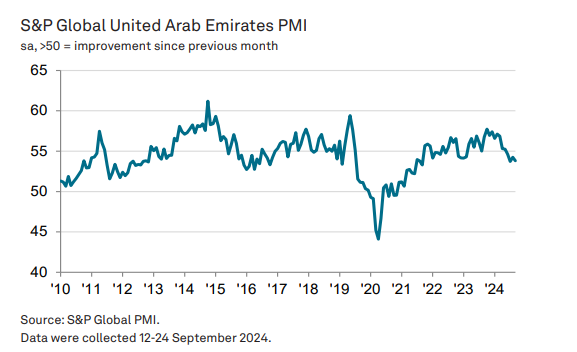

United Arab Emirates (UAE)

The UAE’s non-oil private sector continues to lose momentum, with slower growth and rising challenges in completing new work. Despite a strong increase in purchases, businesses face competition and a more cautious outlook for 2024, with output expectations at their lowest since early 2023. Companies raised prices at the fastest rate in over six years to maximize revenues while sales remain strong, though cost pressures eased slightly in September, potentially signaling a future decline in inflationary trends.

Related Articles

April 2025 Global Logistics & Supply Chain Market Update

U.S. Section 301 Proposals and Global Shipping Dynamics Global Trade Disruptions & Rising Costs

March 2025 Global Trade & Logistics Market Update

Ramadan 2025: Road Restrictions and Their Impact on Logistics in Abu Dhabi With Ramadan 2025 approac

Monthly Update on the Global Logistics Market – February 2025

Major Shifts in Carrier Alliances Reshape Global Shipping Dynamics 2025 marks a pivotal year in the

Post a comment

You must be logged in to post a comment.