The Benefits of Setting up a Business in a UAE Free Zone

Introduction

In a dynamic world where global trade and investment are the cornerstones of economic growth, the United Arab Emirates (UAE) provides numerous opportunities. Key drivers of this economic transformation are the UAE Free Zones – strategic geolocations that attract ambitious entrepreneurs and international corporations.

Moreover, the UAE has an advantageous geographic positioning for businesses. Nestled at the crossroads of the Middle East, Asia, and Europe, it’s now a pivotal hub for international trade and commerce. This global junction allows businesses to connect with key markets seamlessly. This article explores the remarkable advantages of establishing a business in a UAE Free Zone

UAE Free Zones – An Overview

Overview of Free Zones and Their Objectives

UAE Free Zones are designated areas around the region offering businesses favorable conditions for growth, trade, and investment. These zones have specific objectives, such as promoting economic diversification, encouraging Foreign Direct Investment (FDI), and boosting the overall business environment. The primary goals of UAE free zones include:

- 100% foreign ownership, different from the usual UAE company ownership regulations that often require local partnerships.

- Tax exemptions on corporate income tax, import and export duties, personal income tax, and capital gains tax.

- Streamlined processes for business setup, licensing, and permits, which simplifies bureaucracy and accelerates the establishment of companies.

- Modern and advanced infrastructure, including office spaces, warehouses, manufacturing facilities, and logistics support.

- Strategic location near ports, airports, and major transportation hubs, enabling easy access to international markets and global trade routes.

- Different Free Zones catering to specific industries, such as technology, finance, healthcare, media, logistics, and more, fostering synergy among companies in similar sectors.

Key Features That Make UAE Free Zones Attractive

UAE Free Zones offer a range of key features that contribute to their attractiveness for businesses:

Sector-Specific Zones: The UAE has over 40 Free Zones, each catering to specific industries. For instance, Dubai Internet City focuses on technology and media and streamlines distribution services in Dubai while the top companies in Jebel Ali Free Zone Dubai are in the trade and manufacturing industry. This specialization encourages collaboration and innovation within industries.

Full Repatriation of Profits: Businesses operating within Free Zones can fully repatriate their profits and capital without any restrictions, providing financial flexibility for companies and investors.

Easy Company Setup: The process of establishing a business in a Free Zone is straightforward, with minimal bureaucratic hurdles. This includes a simplified application process, fast-track licensing, and efficient visa issuance for employees.

Proximity to Markets: The strategic location of Free Zones near major transportation hubs and global markets facilitates easy import and export activities, enabling companies to efficiently connect with customers worldwide.

Connectivity: World-class infrastructure, high-speed internet, advanced logistics services, and modern facilities create an environment conducive to business growth and expansion.

Flexibility in Activities: Businesses within Free Zones have the flexibility to engage in a wide range of activities, from trading and manufacturing to services and consulting, depending on the specific Free Zone’s regulations.

Key Benefits of Setting Up in a UAE Free Zone

100% Foreign Ownership and Full Control

One of the primary attractions of setting up a business in a UAE Free Zone, with a Dubai based logistics firm, is the opportunity for 100% foreign ownership and full control of the business. Unlike in the mainland UAE, where local sponsors are often required, Free Zones allow foreign investors to retain complete ownership without the need for a local partner. This autonomy gives investors greater control over their business operations and strategic decisions.

Tax Exemptions and Incentives

UAE Free Zones offer a highly advantageous tax environment. Businesses established in these zones typically benefit from complete or substantial tax exemptions. This includes exemption from corporate income tax, personal income tax, import and export duties, and value-added tax (VAT) for most goods and services. These tax incentives significantly enhance the profitability and competitiveness of businesses, making them an attractive option for foreign investors.

Simplified Licensing and Registration Processes

Free Zones are known for their streamlined and efficient licensing and registration processes. The bureaucratic red tape often associated with starting a business is minimized in Free Zones, where a one-stop-shop approach is adopted. This means that entrepreneurs can obtain all necessary licenses, permits, and approvals in a straightforward and timely manner, allowing them to commence operations quickly.

Wide Range of Business Activities Allowed

UAE Free Zones cater to a diverse range of industries and business activities. From manufacturing and trade to technology, media, healthcare, and finance, Free Zones offer flexibility in choosing the type of business to establish. This diversity encourages innovation and allows businesses to tap into their specific expertise, while benefiting from the Free Zone’s conducive environment and sector-specific infrastructure.

Access to Modern Infrastructure and Facilities

Free Zones boast state-of-the-art infrastructure, modern facilities, and advanced amenities that are designed to meet the needs of various industries. From advanced communication networks and technology hubs to industrial parks and office spaces, these zones provide businesses with the necessary tools and resources to operate efficiently and effectively.

Proximity to Global Markets and Supply Chains

The strategic location of many UAE Free Zones offers businesses convenient access to global markets and supply chains. The UAE’s well-connected ports, airports, and transportation networks make it an ideal hub for international trade and logistics. Businesses in Free Zones can easily import and export goods, benefiting from the country’s position as a gateway between East and West.

Advantages of Strategic Location and Connectivity

Strategic location and connectivity are pivotal factors that contribute significantly to the success and attractiveness of UAE Free Zones. Situated at the crossroads of key global trade routes, the United Arab Emirates offers unparalleled access to markets in the Middle East, Asia, and Europe. This strategic advantage provides businesses operating in Free Zones with a range of benefits that fuel their growth and international reach.

Access to Key Markets in the Middle East, Asia, and Europe

The UAE’s central position between three major regions—Middle East, Asia, and Europe—makes its Free Zones a gateway to lucrative markets. Businesses established in these zones can easily tap into the rapidly expanding Middle Eastern markets, such as Saudi Arabia and other Gulf Cooperation Council (GCC) countries. Moreover, the well-established trade links with Asia and Europe enable logistics and warehousing services in Hamriyah Free Zone, for example, to efficiently reach diverse consumer bases and establish global supply chains.

Efficient Transportation and Shipping Connectivity

UAE Free Zones are strategically located near major transportation routes, allowing for efficient movement of goods and services. The country’s excellent road networks, well-maintained highways, and advanced logistics infrastructure facilitate the seamless flow of products within the UAE and across borders. This efficient transportation system significantly reduces transit times and operational costs for businesses, enhancing their competitiveness.

Proximity to Major Ports, Airports, and Logistics Hubs

The UAE is home to world-class ports, airports, and logistics hubs that serve as pivotal nodes for international trade. Free Zones in the UAE are typically situated close to major seaports like Jebel Ali Port, one of the busiest ports in the world, and airports such as Dubai International Airport and Abu Dhabi International Airport. This proximity provides businesses with direct access to reliable shipping routes and global air connections, ensuring timely imports and exports.

Additionally, the presence ofshipping logistics companies in Abu Dhabi Airport Free Zone and similar locations further enhances the efficiency of supply chains. These hubs offer services such as warehousing, distribution, and value-added services, allowing businesses to manage inventory, reduce lead times, and respond swiftly to market demands.

Supportive Ecosystem and Business Community

Collaboration and Networking Opportunities

UAE Free Zones create a conducive environment for collaboration and networking among businesses. The diverse mix of industries within these zones provides opportunities for cross-sector partnerships, knowledge exchange, and innovative collaborations. Regular events, seminars, workshops, and trade fairs organized by Free Zone authorities bring together entrepreneurs, investors, and industry experts, fostering connections that can lead to new business ventures and growth opportunities.

Business Services and Supportive Government Initiatives

UAE Free Zones offer a comprehensive range of business services that support companies at various stages of their growth journey. These services include assistance with company formation, licensing, visa processing, legal support, and more. Additionally, supportive government initiatives, such as business-friendly regulations and investor-friendly policies, create a favorable environment for businesses to thrive. The Free Zone authorities often provide a dedicated point of contact to help businesses navigate regulatory requirements and resolve any operational challenges.

Knowledge Sharing and Skill Development

Transparent Regulations and Investor-Friendly Laws

UAE Free Zones are known for their transparent and business-friendly regulatory frameworks. The legal environment within these zones is designed to attract and facilitate foreign investment. Clear and well-defined regulations govern business operations, ensuring that investors understand their rights and obligations. This transparency reduces ambiguity and fosters a sense of security among businesses, encouraging them to operate confidently and make long-term strategic decisions.

Regulatory Ease and Legal Framework

The United Arab Emirates (UAE) is presently a dynamic hub for tech startups, a landscape of cutting-edge technology and limitless possibilities. Fueled by a forward-thinking government committed to innovation, the region welcomes and celebrates tech pioneers.

Free zones are the main driver of technological advancement in the United Arab Emirates–geographical entities serving as incubators for dreams and creating the perfect conditions for tech startups to thrive. This article explores the world of tech start-ups, uncovering the hidden treasures that free zones offer – from unparalleled business benefits to dynamic networking opportunities – making the UAE a haven and gateway to technological success.

Protection of Intellectual Property Rights

Intellectual property protection is a critical concern for businesses in any industry. UAE Free Zones prioritize the protection of intellectual property rights through robust legal mechanisms. Stringent laws, along with the presence of dedicated intellectual property offices, help safeguard trademarks, copyrights, patents, and trade secrets. This environment provides reassurance to businesses that their innovations and creative works will be protected from infringement.

Flexibility to Repatriate Profits and Capital

UAE Free Zones offer businesses the flexibility to repatriate their profits and capital with ease. Foreign investors can transfer funds in and out of the country without stringent restrictions. This flexibility is particularly appealing to international businesses that seek to allocate profits efficiently and manage their financial resources across global operations.

The regulatory ease and legal framework within UAE Free Zones contribute significantly to attracting foreign investment, promoting innovation, and facilitating a conducive environment for business growth. By providing a transparent and supportive legal landscape, these zones enable businesses to focus on their core operations while enjoying the benefits of a secure and investor-friendly business environment.

How Al Sharqi Can Enhance Your Business Setup in a UAE Free Zone

The United Arab Emirates (UAE) is presently a dynamic hub for tech startups, a landscape of cutting-edge technology and limitless possibilities. Fueled by a forward-thinking government committed to innovation, the region welcomes and celebrates tech pioneers.

Free zones are the main driver of technological advancement in the United Arab Emirates–geographical entities serving as incubators for dreams and creating the perfect conditions for tech startups to thrive. This article explores the world of tech start-ups, uncovering the hidden treasures that free zones offer – from unparalleled business benefits to dynamic networking opportunities – making the UAE a haven and gateway to technological success.

Introduction to Al Sharqi’s Free Zone Setup Services

Al Sharqi is a trusted third-party logistics provider that specializes in assisting companies with setting up in UAE Free Zones. With a deep understanding of the local business landscape and regulatory requirements, we facilitate seamless and successful business establishment in these zones. So, asides being one of the top distribution companies in the United Arab Emirates, we offer the following services.

Expert Consultation and Guidance Throughout the Setup Process

Al Sharqi provides expert consultation and guidance to businesses at every step of the setup process. Their experienced professionals understand the intricacies of UAE Free Zone regulations and can provide valuable insights on choosing the right Free Zone, understanding licensing requirements, and structuring the business model effectively. This guidance helps businesses make informed decisions that align with their goals and industry requirements.

Efficient Handling of Documentation and Legal Procedures

Navigating the documentation and legal procedures involved in setting up a business in a UAE Free Zone can be complex. Al Sharqi’s services include the efficient handling of these processes. This helps businesses avoid delays and potential legal complications, allowing them to start operations promptly.

Al Sharqi is the best shipping company in Abu Dhabi and similar areas in the UAE. In addition to that, we offer expert consultation, guidance, and streamlined handling of legal procedures and contribute to a smooth and hassle-free setup experience, allowing you to focus on your core business activities and accelerate your growth in the dynamic UAE business environment.

Get In Touch

Conclusion

Establishing a presence in a UAE Free Zone can create a strategic business advantage, especially for companies seeking cost-effective storage services in Dubai and around the region. Benefits of free zones are 100% foreign ownership, tax exemptions, ease of regulatory processes, diverse permitted activities, and access to modern infrastructure. Notably, there’s the proximity to key markets and supply chains, facilitated by the UAE’s strategic geographic position.

It’s not just about the benefits, though. Having an adept partner is invaluable. Al Sharqi, a distinguished logistics and supply chain provider, provides the right support and expertise. Our commitment to guiding businesses through the business setup complexities in UAE Free Zones helps entrepreneurs to focus on their core activities. With a deep understanding of the UAE’s legal landscape and a wealth of experience, Al Sharqi is your trusted ally to transform challenges into opportunities and dreams into reality.

FAQs

Our experience in the field and our global network

Free zones in the UAE attract foreign investment, fostering innovation, and creating job opportunities. Furthermore, these zones offer incentives like tax exemptions, simplified regulations, and modern infrastructure, attracting diverse industries. Then, this influx of businesses contributes to increased trade, technology transfer, and knowledge sharing. As a result, free zones drive economic growth, reduce dependence on oil, and position the UAE as a global hub for business and commerce.

Free zones benefits include 100% foreign ownership, tax exemptions, streamlined regulations, and modern infrastructure. They attract foreign investment, drive economic diversification, and foster innovation. Additionally, free zones contribute to job creation, knowledge transfer, and increased trade.

Doing business in the UAE offers advantages like strategic geographic location for efficient logistics, political stability, state-of-the-art infrastructure, and a business-friendly environment. The UAE’s tax-free zones and favorable regulations create a diverse economy, ensuring access to global markets and modern logistics networks to enhance trade opportunities. Moreover, the UAE boasts a skilled workforce, cultural diversity, and continuous government support.

Yes, the UAE is an excellent country to start a business. Its strategic location, investor-friendly policies, tax benefits, and advanced infrastructure make it a thriving hub for entrepreneurship. Supportive government initiatives further enhance its appeal, access to global markets, modern facilities, and a skilled workforce also create ample opportunities.

Related Articles

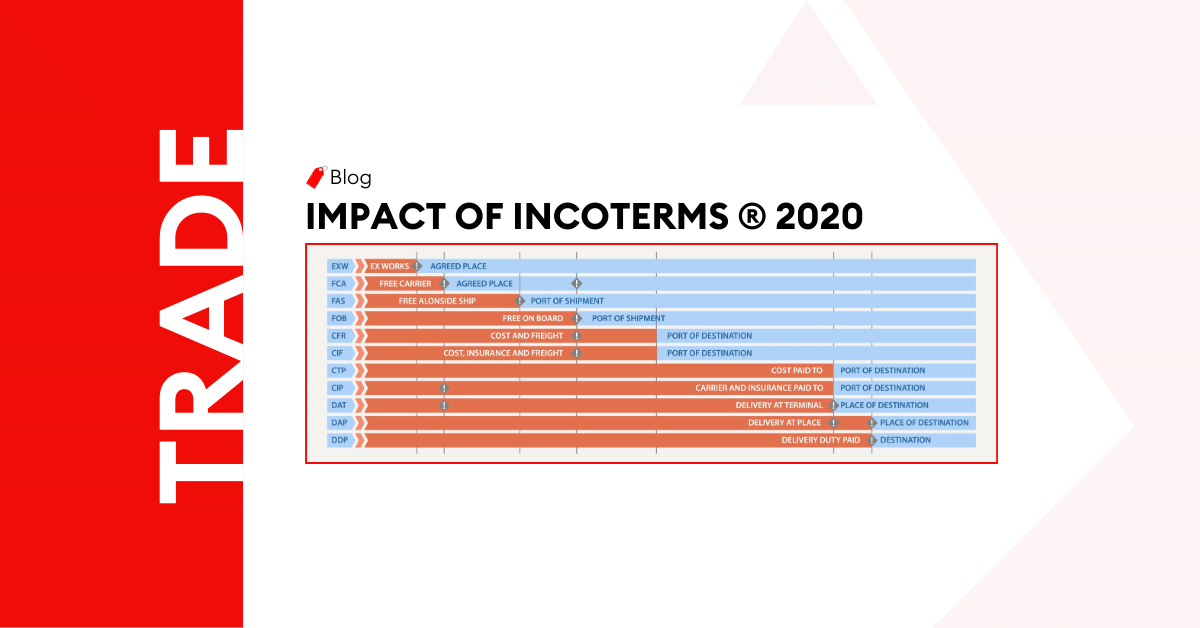

The Impact of Incoterms ® 2020 on Global Trade Explained

Understanding the incoterms is essential if you are shipping goods. These are the rules of commercia

Understanding the Different Types of Free Zones in the UAE

Introduction In the dynamic landscape of the United Arab Emirates (UAE), the concept of free zones h

UAE Free Zone vs. Mainland: Which One is Right for Your Business?

Introduction In the vibrant landscape of the United Arab Emirates, aspiring entrepreneurs often find

Post a comment

You must be logged in to post a comment.